Top 5 Hybrid Inverters South Africa 2025

Top 5 Hybrid Inverters South Africa 2025 Top 10 solar inverter manufacturers in Sout Africa 2025 - 1. LENTO INDUSTRIES PVT. LTD Lento is the best solar inverter manufacturer supplier in

2024 Top 20 Global Photovoltaic Inverter Brands

Dec 6, 2024 · After years of competition, the inverter industry has become quite stable. The overall ranking of the list has not changed much, as most of the

32 Best Solar Inverters In South Africa Expert Picks 2025

May 23, 2025 · Choosing the right solar inverter for your South African home or business in 2025 is a critical decision, much like picking the perfect tool for a complex project – you want

What is a Solar Inverter? Top 10 Solar Inverter

2 days ago · A solar inverter (solar PV inverter) is a dependable and safe power source converter. Learn more about the top 10 solar PV inverter manufacturers.

71 Power Inverter Manufacturers in 2025

71 Power Inverter Manufacturers in 2025 This section provides an overview for power inverters as well as their applications and principles. Also, please take a look at the list of 71 power inverter

West african photovoltaic energy storage inverter

RSA LOCAL SOLAR INVERTER MANUFACTURE RWW ENGINEERING (Pty) Ltd is currently manufacturing Solar PV Inverters for a project in the North West Province of f Deye, and

Daikin to Present High-Efficiency Inverter ACs for Africa at

Aug 8, 2025 · At its exhibition booth, Daikin will highlight its latest high-efficiency inverter air conditioners, designed to address Africa''s pressing cooling needs while reducing energy

Top 10 On-Grid and Hybrid Solar Inverter Companies in South Africa

Apr 3, 2025 · Explore Top 10 On-Grid and Hybrid Solar Inverter Companies in South Africa: Your Ultimate Guide! Discover their unique products, supply chain insights, and key exhibitions to

Best solar Inverter Brands in South Africa 2025 ( complete

We found the following solar inverter manufacturing companies in South Africa, are suitable for utility-scale, commercial and residential projects. They manufacture off grid and on grid solar

Solar Inverter Manufacturers from South Africa

Companies involved in Inverter production, a key component of solar systems. 11 Inverter manufacturers are listed below. ENF Solar is a definitive directory of solar companies and

delta Solar pump inverter supplier in AFRICA / # best 1

Availability of Delta Solar Pump Inverters by Pulse Control in African Regions Pulse Control Industrial Equipment LLC proudly supplies Delta Solar Pump Inverters across a wide range of

Which are the Top Manufacturing Companies of Inverter

May 19, 2025 · Companies with a broad range of inverter products covering string inverters, central inverters, microinverters, hybrid inverters, and EV inverters are better positioned to

Best Inverter South Africa [Updated: August 2025]

Aug 2, 2025 · High-End Inverters: Solar inverters or those for larger systems fall in the $800 to $1,500 range. For instance, a 3,000-watt solar inverter can power multiple home appliances,

6 FAQs about [Africa high-end inverter manufacturers]

What are the best solar inverters in South Africa?

The best solar inverters in South Africa include Sunsynk, Fronius, SolarEdge, Sungrow, SMA, Huawei, GoodWe and Victron Energy, MLT Drives, Microcare Solar Systems, Ellies Renewable Energy, SolaX Power Africa, Renewvia Energy South Africa, Canadian Solar South Africa, and JA Solar.

Where do solar inverters come from in South Africa?

South Africa’s solar inverter supply chain is a mix of local manufacturers, importers, and distributors. Local production is limited—most inverters are imported from global hubs like China, Europe, and the U.S. Importers and distributors are the real MVPs here, bringing these products from factories to your doorstep.

Why do South African households need high-performance solar inverters?

With the growing competition and decreasing prices, South African households now have access to a wide range of high-performance solar inverters, ensuring a reliable and efficient transition to sustainable energy solutions. by Hanno Labuschagne

Which solar inverter brand is best?

Leading Solar Inverter Brands in South Africa Solis, the third-largest inverter manufacturer globally, is highly regarded for its feature-rich and cost-effective solutions. Rubicon’s Managing Director Greg Blandford praised Solis for its flexibility, scalability, and strong local support, making it one of the top choices for hybrid solar inverters.

Who makes solar power in South Africa?

1. SolarEdge Technologies South Africa 2. SMA Solar Technology South Africa 3. Fronius South Africa 4. South Africa 5. Schneider Electric South Africa 6. Huawei South Africa 7. Sungrow South Africa 8. Growatt South Africa 9. Solis South Africa 10. GoodWe South Africa Part 6. Manufacturing Centers Hey there!

Where do solar inverters come from?

Local production is limited—most inverters are imported from global hubs like China, Europe, and the U.S. Importers and distributors are the real MVPs here, bringing these products from factories to your doorstep. It’s a dynamic system keeping South Africa’s solar dreams alive.

Update Information

- Recommended inverter manufacturers for Honiara enterprises

- Peru Arequipa high-end inverter custom manufacturer

- Off-grid inverter company in Johannesburg South Africa

- China-Africa high-end inverter custom manufacturer

- High-end inverter pure sine wave

- Recommended local inverter manufacturers in Brazil

- North Africa Solar 24v Inverter

- Complementary inverter manufacturers

- Africa sine wave inverter solution

- Communication base station inverter cabinet manufacturers spot

- Georgia Solar Inverter Manufacturers

- Inverter manufacturers in Papua New Guinea

- Ghana inverter manufacturers

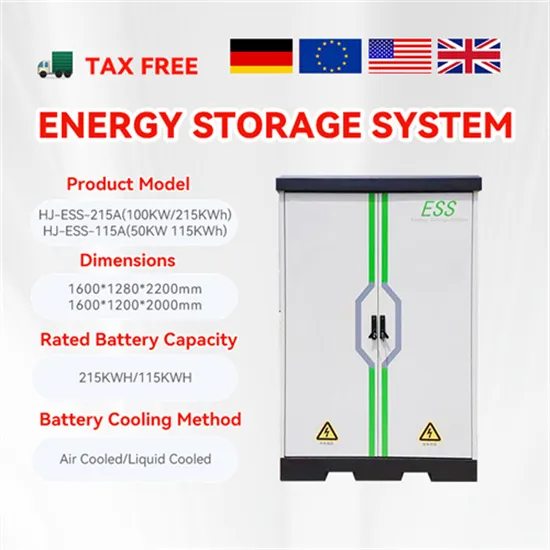

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.