Republic of North Macedonia: 2023 Article IV

Jan 25, 2024 · The successful completion of the first review marks a significant step in enhancing North Macedonia''s economic resilience. The authorities are progressing towards PLL

THE IMPACT OF THE FOOD AND ENERGY CRISIS ON

Feb 9, 2024 · Rising food and energy prices and decelerating incomes afect household welfare in North Macedonia. Rising prices of primary food products and of the wider consumer basket

5G regulation and law in North Macedonia | CMS Expert

Mar 4, 2025 · By the end of 2023 - a 5G signal must be available in at least one city. By the end of 2025 - a 5G signal must be available in the main transport corridors (basic road network). By

Top 60KW DC Fast Charging Station in North Macedonia

Introduction to 60KW DC Fast Charging Stations DC fast chargers are capable of delivering high power, significantly reducing the charging time for electric vehicles compared to standard AC

IMF Country Report No. 24/27 REPUBLIC OF NORTH

Jan 25, 2024 · North Macedonia is a relatively energy-intensive economy with a fossil -fuel-dominated energy mix, driving the country''s Green House Gas (GHG) emissions. Coal -based

North Macedonia: Legal and Regulatory Challenges for 5G

Feb 28, 2025 · With the rollout of 5G technology, North Macedonia will have to clear a number of legal and regulatory hurdles before benefitting from its potential to transform industries,

North Macedonia: Subsidies for preferential RES electricity

Jun 15, 2021 · Preferential producers participate with 6.17 % in North Macedonia''s total electricity production. The support scheme envisaged guaranteed purchase of produced electricity at

Measurements of the non-ionizing radiation of 5G base station

Feb 21, 2024 · This paper presents some measurements and evaluation of the parameters of the base station for transmitting 5G signals in the network of Makedonski telekom AD Skopje at

The construction of 5G network brings the demise of the

Dec 26, 2022 · At the signing of the Memorandum two years ago in the capital Skopje, North Macedonia and the USA stressed the importance of encouraging participation of relevant and

North Macedonia Faces Severe Climate Change Impacts and

Oct 7, 2024 · North Macedonia Climate Public Finance Review, presented today alongside the CCDR, underscores that tax policies could incentivize renewable energy, green transportation

North Macedonia Telecoms, Mobile and Broadband Market

Dublin, Feb. 14, 2023 (GLOBE NEWSWIRE) -- The "North Macedonia - Telecoms, Mobile and Broadband - Statistics and Analyses" report has been added to ResearchAndMarkets ''s

The electricity subsidy does not reduce the price of bread in Macedonia

Dec 4, 2022 · The Minister of Economy in North Macedonia, Kreshnik Bekteshi, has said that all companies that have benefited from the energy subsidy should lower the prices of their

The construction of the 5G network brings the demise of the

May 23, 2001 · Both Macedonian Telecom and A1 Macedonia initiated procurement procedures for the telecommunications infrastructure for 5G networks throughout North Macedonia. The

Global 5G Progress-Europe, USA, China, Japan, South Korea

Latest 5G Progress In The World According to the data released by GSA, as of December 2020, 140 operators in 59 countries and regions around the world have opened 5G base stations

6 FAQs about [North Macedonia 5G base station electricity subsidy]

Does North Macedonia need 5G?

One condition determines that at least one North Macedonian city needs to have uninterrupted 5G coverage by the end of 2023, and all remaining cities by 2027, while the second condition expects that all citizens must be provided with 5G access with a minimum downlink of 100Mbps by 2029.27

What percentage of Macedonia has a 4G network?

The network covers 99.9% of the population and over 98.5% of the territory of North Macedonia. Makedonski was the first telecommunications company in the country to introduce 4G LTE, GPRS, EDGE and various converged internet and mobile services.

Does A1 Macedonia have a 5G network?

By the end of 2022, A1 started building its 5G network and accomplishing coverage of 56,6 % of the total population. Tourist centres, such as Ohrid Lake, are covered by LTE network and A1 Macedonia will continue investing in its modernisation.

Which mobile network operator in North Macedonia has the fastest mobile network?

A1 describe themselves as the leading mobile network operator and number two in the fixed-line market in North Macedonia. They say that have the fastest mobile network in the country. On top of this, the mobile network is becoming even faster by launching 5G.

How many NB-IoT base stations are installed in Macedonia?

Makedonski also revealed that it has installed 900 new NB-IoT (narrowband IoT) enabled base stations for M2M communication in the country, with capacity of the new modernized network up by 70 percent. A1 describe themselves as the leading mobile network operator and number two in the fixed-line market in North Macedonia.

Did Makedonski Telekom perform the first 5G demo in North Macedonia?

In September 2018, Makedonski Telekom, which has the largest share of the broadband market in North Macedonia, informed that it performed the first 5G demo in the country, claiming the tests results of the tests reached the highest Internet speed registered. On that occasion, the operator also claimed that the

Update Information

- North Africa 5G base station electricity policy

- How much is the annual electricity cost of 5g base station

- 5g base station power supply electricity charges are high

- How much is the electricity price of 5g base station in Chisinau

- 5g base station night electricity bill

- North Asia Communications 5MWH Liquid Cooling 5G Base Station

- Greece 5G base station electricity subsidies

- 5g base station operators can t afford the electricity bill

- Ecuador 5g base station smart electricity use

- Tanzania Electricity Company 5G base station

- What are the requirements for 5G base station electricity

- Tehran 5g base station electricity consumption

- Cyprus 5G base station electricity prices

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

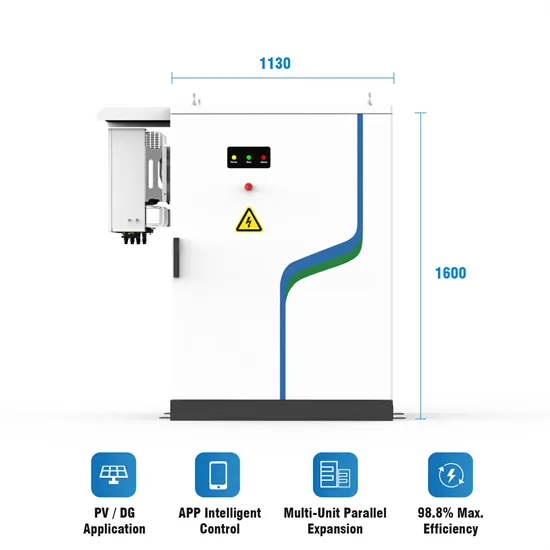

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.