Top 5 Super Capacitor Companies in Global 2025 | Global

Jul 15, 2025 · Global Distribution of Super Capacitor Manufacturers by Country in 2025 The global distribution of super capacitor manufacturers in 2025 reflects the industry''s strong ties to

Top Companies List of Supercapacitor Industry

Broader support for clean energy, electrification, and sustainable mobility continues to drive adoption across end-use industries. Major players operating in the supercapacitor market

South Korea Super Capacitor Market Size, Share and Growth

South Korea Super Capacitor Market is projected to reach USD 4,000 Million at a CAGR of 25.811% by 2035, South Korea Super Capacitor Industry Growth by Type, Material,

List of Capacitors companies in South Korea

We, IBL Co., Ltd are supplying for electronic components as Aluminum Electrolytic Capacitors, Super Capacitor, DC Link AC Filter Snubber Capacitor and EOCR (Electronic Over Current

South Korea Organic Supercapacitor Market Overview: Key

Jun 24, 2025 · South Korea Organic Supercapacitor Market size is estimated to be USD 200 Million in 2024 and is expected to reach USD 800 Million by 2033 at a CAGR of 17.5% from

14 Best Universities In Busan For International Students 2025

Aug 19, 2025 · Here are 14 best universities in Busan for international students according to academic excellence and internationalization. The best university in Busan is Pusan National

100+ Best Universities in South Korea [2025 Rankings]

Mar 2, 2025 · The best cities to study in South Korea based on the number of universities and their ranks are Seoul, Daejeon, Pohang, and Busan. Average cost of living for students in

Top 10 Supercapacitor Manufacturers in the

2 days ago · This article profiles the top 10 global supercapacitor manufacturers providing state of the art ultracapacitor cells and modules catering to varying

South Korea Top 100 Institutions Rankings

South Korea Top Countries in World 2025This list presents the top 100 institutions worldwide—by continent, country, and institution type—based on near real-time scientific performance data.

Ranking of energy storage capacitor manufacturers

Which supercapacitor company produces 500 million Ah lithium ion batteries? Recent layout: LISHENin top 10 supercapacitor companies now has an annual production capacity of 500

6 FAQs about [Ranking of Super Capacitor Manufacturers in Busan South Korea]

What is a capacitor in South Korea?

A capacitor is a device that stores electrical energy in an electric field. It is a passive electronic component with two terminals. Are you looking for the best Capacitor Manufacturers and Suppliers in South Korea? Do you want to know where to buy capacitors locally in South Korea? Which popular capacitor distributor in South Korea near me?

Who are the major players in supercapacitor market?

Panasonic Corp. (Japan), Maxwell Technologies (South Korea), Eaton (Ireland), Nippon Chemi-Con Corp. (Japan), CAP-XX (Australia), Cornell-Dubilier (US), and Ioxus (US) among others are the key players in the supercapacitor market.

What does a supercapacitor manufacturer do?

Manufactures capacitors with emphasis on supercapacitor technologies for electric applications. Manufacturing expertise ensures large production volumes to meet demand. Focus on R&D to enhance product efficiency and market adaptability. Contributes to the energy storage market with focus on supercapacitors and integrated solutions.

What is the global supercapacitor market size?

The global supercapacitor market size is anticipated to grow from USD 472 million in 2022 to USD 912 million by 2027, at a CAGR of 14.1% from 2022 to 2027.

What is a compact supercapacitor?

Compact supercapacitor designs cater to niche markets with specific needs. Focus on miniaturization of supercapacitors for electronic devices and wearables. Engages in diverse technological solutions, including advanced energy storage products. Integrates supercapacitor technology into solar energy systems, improving energy efficiency.

Who is samwha capacitor group?

During the last half a century, Samwha Capacitor Group has been faithfully performing its role as the “Seed Company” for the development of Korea electronics industry and has become a global leading company by establishing on-site production and sales subsidiaries in eleven sites in eight nations all over the world.

Update Information

- Myanmar Super Capacitor Manufacturers Ranking

- South Korea container manufacturers wholesale

- Photovoltaic solar panel brand in Busan South Korea

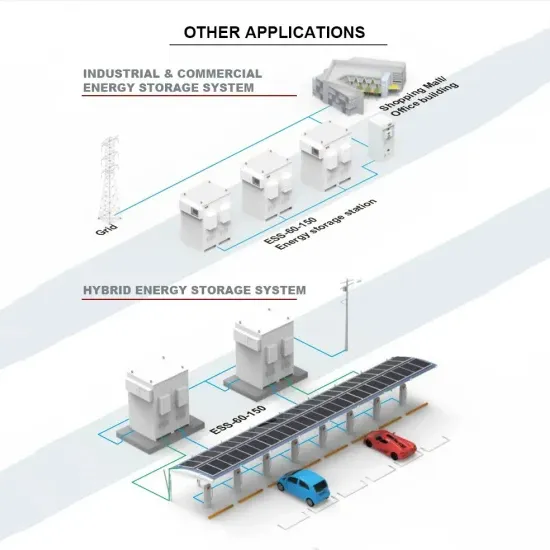

- Busan South Korea energy storage equipment new energy enterprise

- Busan South Korea energy storage supercapacitor price

- Super power storage large capacity capacitor

- Super large capacitor amplifier

- Super high current capacitor manufacturer

- Super capacitor price in Nepal

- Super lithium capacitor manufacturer in Barcelona Spain

- Algiers Super Smart Capacitor

- Super Farad capacitor 12v voltage

- Huawei 5G communication base station super capacitor equipment supplier

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.