华为基站设备介绍

华为基站设备介绍 一、概述 华为作为全球领先的通信设备和解决方案提供商,其基站设备在无线通信网络中扮演着至关重要的角色。华为的基站设备不仅具备高性能、高可靠性和高可扩展性

Base Station Operation Increases the Efficiency of Network

These results indicate that base station operation can help operators efficiently build networks and effectively shorten the ROI period. Base Station Operation Has a Bright Future According to

基地局バックホールマイクロ波ソリューション | Huawei

Aug 4, 2025 · 無線基地局は広く分散されており、バックホールネットワークには高い品質が要求されます。 基地局の有線伝送は,高い建設費,長い建設期間,高いO&Mコストを必要とします

Small Cell,大数据时代网络商业模式

Small Cell是指支持发射功率<=10W的室内外产品,以及相应的传输、站点配套等的无线基站解决方案。 华为Small Cell室内数字化解决方案完美满足了MBB时

Base Station Operation, efficiently transforming mobile to FMC

The idea behind base station operation is to develop FBB around base stations. This construction mode can fully utilize mobile operators'' large quantities of base stations. Under this mode,

Huawei''s 5G Base Station Shipments Exceed 1.2 Million

Jun 27, 2025 · During the convention of "2022 World Telecommunications and Information Society Day" held recently, Jiang Yafei, Senior Vice President of Huawei Technologies Co.,

华为基站设备介绍

微基站(Micro Base Station) 定义:微基站是体积较小、重量较轻的基站设备,适用于城市密集区、室内等场景。 特点:易于安装和维护;支持灵活组网,可根据需求进行扩容;具备智能

DBS5900 Distributed Base Stations

Aug 2, 2025 · DBS5900 Distributed Base Stations The DBS5900 is a wireless access device for the eLTE wireless broadband private network solution. It provides wireless access functions,

Huawei Maintains the Top Position in the Global Passive

Dec 17, 2024 · In their latest report, the global technology market intelligence firm ABI Research released its 2023 global base station antenna market research report titled "Passive Cellular

移动基站 | Application

移动基站中的有源天线系统 (AAS) 是指可将天线和射频 (RF) 组件集成在一个单元中的收发器。 这种集成既可提高移动网络的性能, 又能实现以下一些先进功能: 波束赋形 AAS能够形成窄波

6 FAQs about [Huawei Mini Mobile Base Station]

What is a Huawei base station?

Let's dive into a technical explanation. A base station, also known as an eNodeB (for 4G LTE) or gNodeB (for 5G NR) in Huawei's terminology, is a piece of equipment that facilitates wireless communication between user equipment (UE) like smartphones, tablets, and IoT devices, and the core network of the telecommunications provider.

What is Huawei base station backhaul microwave?

Based on leading wireless, transmission, and datacom technologies, Huawei base station backhaul microwave solution provides fiber-level broadband wireless backhaul capabilities, ultra-low latency, fully modular architecture design, and co-site integration with wireless networks.

What systems does Huawei offer?

Huawei provides comprehensive management and control systems, such as Huawei's U2000 or Huawei's Cloud BTS. These systems enable operators to monitor, configure, and manage base stations remotely, ensuring optimal network performance and reliability.

What is the difference between a wireless base station and a microwave base station?

Wireless base stations are widely distributed, and the backhaul network requires high quality. The wired transmission of base stations requires high construction costs, long construction period, and high O&M costs. Microwave transmission is fast in network construction and provides a carrier-class availability of up to 99.999%.

What is a base station antenna system?

Antenna System: At the heart of a base station is the antenna system. This system radiates and receives radio frequency (RF) signals to and from mobile devices.

What is coordinated delivery of base stations & microwave devices?

Coordinated delivery of base stations and microwave devices supports fast base station deployment and service provisioning. 10 Gbit/s to-site large broadband backhaul, TDM/IP multi-service interfaces, 50 microsecond ultra-low latency, meeting 5G-oriented base station backhaul requirements.

Update Information

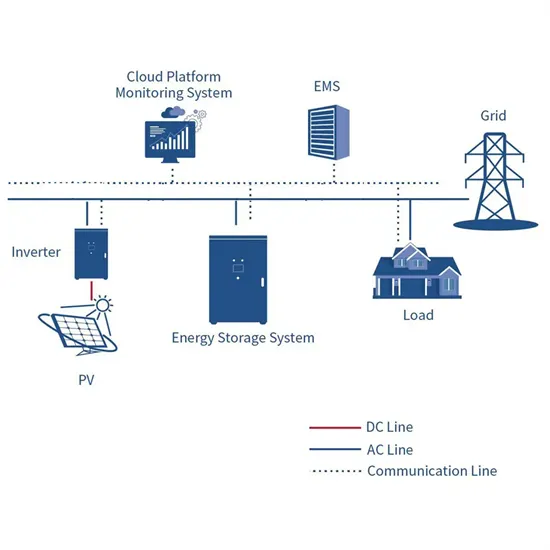

- Lusaka Mobile Huawei Communication Base Station Battery Energy Storage System

- Namibia Mobile Huawei Communication Base Station Battery Energy Storage System

- Ecuador Mobile Base Station Battery Case

- Mobile base station equipment solar panel usage fee

- How many mobile base station sites are there in Afghanistan

- Mobile Energy Storage Base Station

- Unmanned Huawei signal base station solar energy

- Mobile Base Station Energy Management

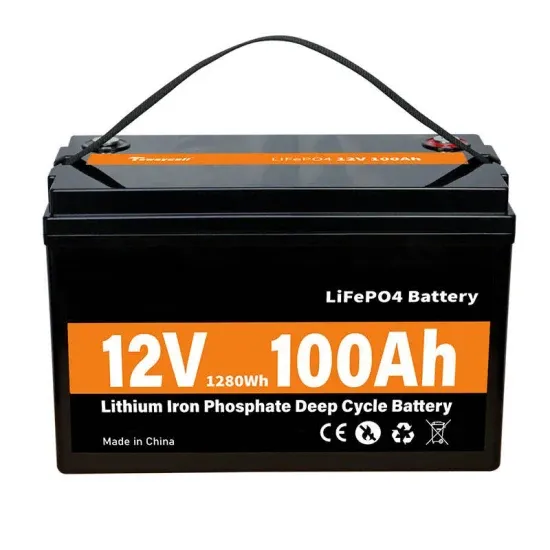

- Base station battery to mobile power supply

- Mobile base station power supply wind power system

- Mobile base station power solar energy

- Why does Huawei s 5G base station consume so much power

- Huawei Communication Base Station Lead-acid Battery Field

Solar Storage Container Market Growth

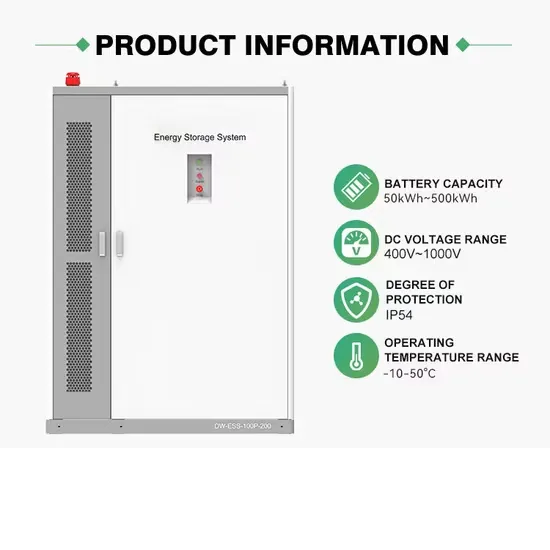

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.