MEGA INDUSTRY (THAILAND)CO.,LTD-MEGA INDUSTRY (THAILAND

Jan 16, 2025 · Mega Industry (Thailand) Co.,Ltd is a professional solar distributor in Southeast Asia. As founded in January 2019,Mega Industry is committed to providing a wide range of A

TOP 5 3 phase off grid solar inverter Manufacturer in Thailand

Sep 4, 2024 · Top Solar Inverter Manufactures in Thailand In recent years, the country has become home to a variety of innovative solar energy developments. One of the biggest

Top Solar Equipment Manufacturers in Thailand

5 days ago · In the simplest terms, manufacturing is the process of producing actual goods or items/products through the use of raw materials, human labour, use of machinery, tools and

หน้าหลัก

บริษัท ชยนันต์ ซัพพลาย จำกัด ผู้จัดจำหน่ายอินเวอร์เตอร์ INVT โดยได้รับการแต่งตั้งจาก INVT (Shenzhen INVT Electric Co., Ltd)อย่างเป็นทางการ (INVT''s golden

Top Solar inverter Manufacturers Suppliers in Thailand

2 days ago · Wholesale Solar Inverters for sale Besides solar panels, there are other components like solar inverters that are critical for both consumers and businesses. Particularly, if you are

ไทยอินเวอร์เตอร์

N&P LTD., PART. ตัวแทนจำหน่าย Inverter หลากหลายประเภท ตัวแทนจำหน่ายอินเวอร์เตอร์ ให้คำปรึกษาโดยทีมวิศกร

Top 20 Solar Inverter Manufacturers: A Global Overview of

Nov 26, 2024 · Discover the top 20 Solar Inverter Manufacturers worldwide, showcasing leading brands and their innovations in clean energy solutions.

Inverter Supplier Insights: Thailand''s Top 8 Options | Mingch

Jun 27, 2025 · In this blog, we highlight the top 8 inverter manufacturers in Thailand known for quality, innovation, and customer support. We also spotlight MINGCH Electrical, a trusted

GM Energy Co., Ltd is originated from the leading photovoltaic inverter

Empowering Thailand with Solar Energy GM Energy Co., Ltd. is a leading EPC company in Thailand, specializing in solar power systems since 2008. We provide end-to-end solar

Inverter Manufacturer and Distributor

6 days ago · ND1 INVERTER (Variable Speed Drive AC Motor) โซลาร์ปั๊มอินเวอร์เตอร์ NV SOLAR PUMP INVERTER มอเตอร์ ซอฟต์ สตาร์ท NV

List of Inverter companies in Thailand

Thai Energy Conservation Co., Ltd. has been the leading manufacturer of energy saving products in Thailand, founded 1994. The company was expanded from original magnetic ballast factory

Top 10 Solar Panel Manufacturers in Thailand 2024

Mar 8, 2024 · In the heart of Southeast Asia, Thailand shines brightly as a hub for renewable energy innovation and development. With an ever-increasing focus

Top Solar inverter Manufacturers Suppliers in Thailand

2 days ago · Currently, the country enjoys a significant presence of local and foreign solar product suppliers and producers across various categories. Thailand''s solar market prospects are

6 FAQs about [Thailand inverter manufacturer]

What makes Thailand's solar inverter industry unique?

Thailand’s journey towards renewable energy dominance is marked by the innovative strides of its solar inverter manufacturers. From Bangkok’s bustling markets to Chonburi’s industrial heartlands, the country is carving out a niche for itself on the global stage, powered by companies like Enphase, Huawei, Sofar, Solax, and Victron Energy.

Where are solar inverters made in Thailand?

A short drive southeast from Bangkok brings you to Chonburi, a province that has rapidly transformed into a manufacturing powerhouse for solar inverters in Thailand. Its rise is attributed to the expansive Eastern Seaboard Industrial Estate and other industrial zones that are home to state-of-the-art manufacturing facilities.

Who is Sofar inverter Thailand?

From its base in Bangkok, Sofar Inverter Thailand offers a diverse range of solar inverter products, including grid-tied inverters, hybrid inverters, and battery storage solutions. This wide product spectrum ensures that Sofar can meet the varied needs of the Thai solar sector, from residential rooftop installations to commercial solar farms

Which solar company is based in Thailand?

Operating out of Bangkok, Huawei leverages Thailand’s strategic position in Southeast Asia to expand its reach, supplying cutting-edge solar technology that is both accessible and reliable. Sofar Inverter Thailand, part of the global Sofar Solar brand, has established itself as a significant player in the Thai solar market.

Who is Huawei solar inverter Thailand?

Huawei Solar Inverter Thailand represents the formidable presence of the global telecommunications giant in the renewable energy sphere. With a focus on intelligent and efficient energy solutions, Huawei offers a wide range of solar inverters that cater to the needs of both small-scale residential setups and large-scale commercial projects.

Who is victron energy Thailand?

Victron Energy Thailand brings Dutch engineering excellence to the Thai solar market. With a rich history dating back to its founding, Victron has been a pioneer in power solutions, including solar inverters, battery chargers, and monitoring systems.

Update Information

- Thailand inverter manufacturer

- Best wholesale 600w solar inverter manufacturer

- Photovoltaic inverter container in Chiang Mai Thailand

- Warsaw communication base station inverter manufacturer

- Rabat three-phase inverter manufacturer

- Vienna Traffic Inverter Manufacturer Price

- Inverter Manufacturer Power Supply

- Dublin Standard Inverter Manufacturer

- Castrie PV Module Inverter Manufacturer

- IPM smart inverter manufacturer in Busan South Korea

- Reykjavik power inverter manufacturer

- Sine Wave Inverter Manufacturer in Philippines

- Qatar high-end inverter manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

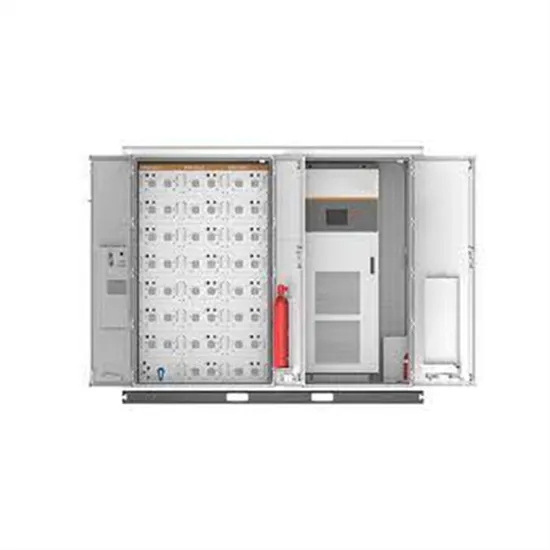

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.