PowerChina begins construction of 1GW/6GWh BESS project

Jul 3, 2025 · Rendering of the 6GWh LFP battery storage project in Ulanqab, central Inner Mongolia, China. Image: PowerChina. PowerChina has begun construction on what is claimed

World''s largest sodium-ion BESS starts operation

Jul 12, 2024 · The Qianjiang power station, which consists of 42 battery energy storage containers and 21 sets of boost converters, uses 185Ah large-capacity

500Ah+ cells becoming new BESS industry standard as Chinese

Jun 25, 2025 · Against this backdrop, storage companies have launched a new round of technology competition centred on next-generation storage cells. First, the race to define third

Opportunities and challenges for the booming battery

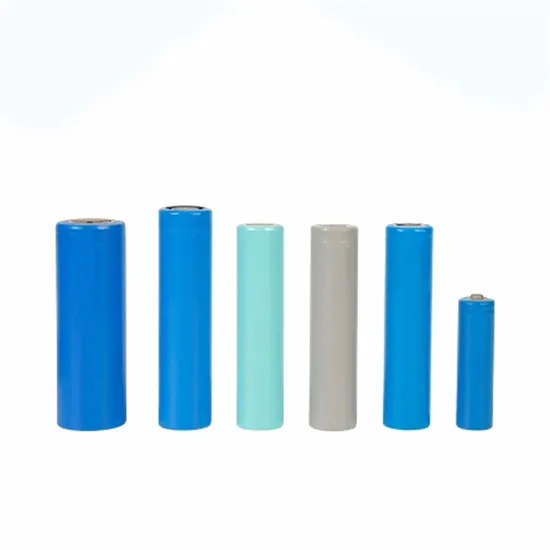

Diversification of battery energy storage systems (BESS) Lithium-ion batteries (led by LFP – lithium ferro-phosphate) currently occupy the dominant position in China''s BESS market and

Grid Storage at $66/kWh: The World Just Changed

Mar 31, 2025 · The Power Construction Corporation of China drew 76 bidders for its tender of 16 GWh of lithium iron phosphate (LFP) battery energy storage systems (BESS), according to

Battery-based Energy Storage in China: New

Apr 1, 2020 · China''s new infrastrucuture investment policy provide new growth momentum to the country''s battery-based energy storage system. Review of 5 business models.

Bess battery storage in china in algeria

Our corporation primarily engaged and export Bess battery storage in china in algeria. we depend on sturdy technical force and continually create sophisticated technologies to meet the

The China Battery Energy Storage System (BESS) Market –

With the growth of renewable energy and goals for carbon neutrality, Battery Energy Storage System (BESS) is pivotal in China''s journey to net zero emissions. The article explores BESS

Latest Ongoing Battery Energy Storage System (BESS) Projects in Algeria

Aug 4, 2025 · Search all the ongoing (work-in-progress) battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Algeria with our

Top Lithium Battery Suppliers in Algeria | Vantom Power

VANTOM POWER is Algeria''s leading Battery Energy Storage Systems (BESS) provider. With more than 10 years of experience in the energy storage industry, we have established

Battery Energy Storage Systems from China

Jun 20, 2024 · EXECUTIVE SUMMARY China has a dominant position in the battery supply chain, limiting the options of procuring Battery Energy Storage Systems (BESS) from US

6 FAQs about [Bess battery storage in China in Algeria]

What is battery energy storage system (BESS)?

With the growth of renewable energy and goals for carbon neutrality, Battery Energy Storage System (BESS) is pivotal in China's journey to net zero emissions. The article explores BESS concepts, development financing, related policies, sector development, and market outlook for the Chinese mainland market, highlighting its benefits and advantages.

What is a Bess battery & how does it work?

When energy is needed, it is released from the BESS to power demand to lessen any disparity between energy demand and energy generation. BESS types include those that use lead-acid batteries, lithium-ion batteries, flow batteries, high-temperature batteries and zinc batteries.

Who are the top ten battery storage system integrators in China?

In the domestic market, the top ten battery storage system integrators in China for 2023 are: 1. CRRC Zhuzhou Electric Locomotive Research Institute – A leader in energy storage systems with a strong domestic presence. 2. HaiBo Science & Technology – Noted for its advancements and substantial market share. 3.

Who are the best energy storage companies in China?

3. Xinyuan Zhichu – Recognized for its innovative energy storage solutions. 4. Envision Energy – A major player in the energy sector with a significant market footprint. 5. Electric Power Times – Known for its comprehensive energy storage systems. 6. Ronghe Yuan Storage – A prominent name in energy storage integration.

Which Chinese companies use lithium batteries in base stations & data centers?

In the global market for lithium batteries used in base stations and data centers, the top five Chinese companies are: 1. Shuangdeng – Leading the market with high-performance lithium batteries. 2. Nandu Power Supply – Known for its reliable lithium battery solutions.

How will China's Dual-carbon strategy affect energy storage?

Henry Zhang, Senior Director, Consulting, South China, and author of the Chinese language version of the report, said, “Under China’s dual-carbon strategy, it is also imperative to adjust the global energy structure. Energy storage plays a role in multiple scenarios. Increased demand will spur explosive growth in energy storage mechanisms.

Update Information

- China bess battery storage for sale company

- Best bess battery storage in China exporter

- Bess battery storage in China in Johannesburg

- Best bess battery storage in China Price

- High quality bess battery storage in China distributor

- Home battery storage in China in Thailand

- Algeria lithium battery energy storage project

- High quality home battery storage in China exporter

- Bess battery storage for sale in Brasilia

- 5kwh battery storage in China in Oman

- Kuwait EK Energy Storage Battery BESS

- Energy Storage Station Battery BESS

- Home battery storage in China in Sweden

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.