Sweden s first energy storage system

The large-scale battery storage system in Landskrona/Sweden helps to stabilize the grid. Axpo commissioned its first large-scale battery storage facility in Sweden. It was connected to the

EDP begins construction of its first stand-alone storage project

EDP, through EDP Renewables, has started the construction of its first stand-alone battery energy storage (BESS) project in Europe, a milestone that materializes the company''s ambition to

DTEK Completes Acquisition of 133 MW Battery Project in Poland

Aug 1, 2024 · DRI, the EU renewables arm of Ukrainian private energy group DTEK, has completed the acquisition of a 133-MW/532-MWh battery energy storage system (BESS)

Biggest projects in the energy storage industry in 2024

Dec 25, 2024 · Following similar pieces in 2022/23, we look at the biggest energy storage projects, lithium and non-lithium, that we''ve reported on in 2024.

White paper BATTERY ENERGY STORAGE SYSTEMS

Jun 24, 2024 · The majority of newly installed large-scale electricity storage systems in recent years utilise lithium-ion chemistries for increased grid resiliency and sustainability. The

DRI Progresses 133MW Trzebinia Battery Storage Project,

Jul 24, 2024 · Today, DRI has taken an important next step on its 133 mw 4h (532 mwh) battery storage project in trzebinia, poland, by acquiring 100% of the shares from columbus energy.

Sweden''s largest battery storage – a front-edge project to

The Stockholm School Properties Company (SISAB) has developed and tested an innovative approach to make their buildings'' electricity use more efficient using high-resolution real-time

Southern European Energy Storage Lithium Battery

New lithium energy storage system technology Sunlight Li.ON ESS set to bolster Europe''''s booming energy storage market, offering high energy density, extended lifespan, and minimal

EU project SMHYLES develops novel salt

Mar 8, 2024 · The recently launched EU project SMHYLES aims to develop innovative, sustainable, and safe salt- and/or water-based hybrid energy storage systems. These combine

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Discover the current state of energy storage companies in Europe, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Chinese Companies Secure Landmark Energy Storage Contracts in Europe

Dec 18, 2024 · From PENGPAINEWS Chinese energy storage companies are making waves in global markets, securing several high-profile contracts across Europe, South Africa, and

New report: European battery storage grows 15% in 2024, EU energy

May 7, 2025 · 21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing

Poland: Tender for construction of 263 MW battery

Jul 25, 2024 · The company''s stated goal is to build a 5 GW portfolio of renewable energy and storage projects in Europe by 2030, via DRI, with up to 1 GW of assets in Poland alone. DRI

Source Galileo sells 40MW BESS Project to Trina Solar

Feb 6, 2025 · Source Galileo, a leading European renewable energy developer, has announced the sale of a 40MW Battery Energy Storage System (BESS) project to Trina Solar International

6 FAQs about [Southern European company develops energy storage project]

What is European energy's new battery storage project?

This is done in collaboration with Kragerup Estate. This is the first battery storage project that European Energy has undertaken in Denmark, and it will provide valuable operational experience in integrating battery solutions with the grid for the company.

What is the British Mendi battery energy storage project?

On August 25, the largest energy storage project in Europe developed by China Huaneng Group Co., Ltd.—the British Mendi Battery Energy Storage Project began cold commissioning. This marked the project's entry into the final stage of development and is scheduled to be put into commercial operation by the end of the year.

How many battery energy storage systems were installed in Europe in 2024?

21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing Europe’s total battery fleet to 61.1 GWh. However, the annual growth rate slowed down to 15% in 2024, after three consecutive years of doubling newly added capacity.

Does European energy have a battery storage project in Denmark?

European Energy breaks ground on battery storage in Denmark together with Kragerup Estate. Project to provide operational experience for European Energy in integration of battery solutions. Copenhagen, Denmark, 20th of January 2025 – European Energy has started on its first large-scale battery storage project.

Is energy storage a good investment in Europe?

Compared to classic renewables, energy storage has really only become an investable asset in Europe over the last few years on the back of technology advances, market price signals, and government support mechanisms.

How much energy storage will Europe have by 2050?

Overall, total energy storage in Europe is expected to increase to about 375 gigawatts by 2050, from 15 gigawatts last year, according to BloombergNEF. We spoke with Grebien about electricity market trends, energy storage technologies, as well as the investment and financing opportunities emerging from these technologies.

Update Information

- Nine Company Energy Storage Project

- Huawei develops energy storage project in Tashkent

- Southern European household energy storage power supply manufacturers

- Guinea-Bissau Energy Storage Integrated System Factory Project

- Austria Energy Storage Power Station Construction Project

- New Zealand Energy Storage Project

- China Southern Power Grid Lithium Battery Energy Storage

- Huawei Malawi Battery Energy Storage Project

- Nanya Photovoltaic Centralized Energy Storage Project

- Huawei deploys energy storage project in Helsinki

- Huawei Energy Storage Product Project

- Huawei Bahrain Energy Storage Industry Project

- 100g photovoltaic energy storage project

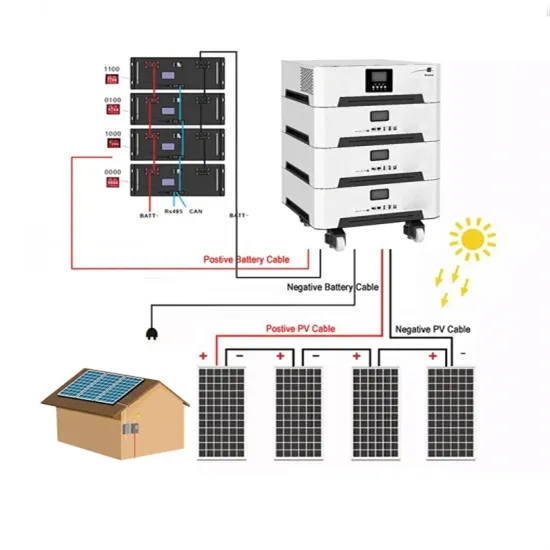

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.