Recently, Shanghai Electric Energy Storage Technology Co., Ltd

Recently, Shanghai Electric Energy Storage Technology Co., Ltd. successfully won the bid for the 10mW/40MWh all-vanadium liquid flow energy storage project at the Fengxian Spark

Flow Battery Market to Grow at a CAGR of 21.51% from 2025

20 hours ago · The flow battery market is experiencing significant growth due to rising demand for long-duration energy storage systems, especially as the world shifts toward renewable energy

The Rise of Vanadium Redox Flow Batteries

May 29, 2024 · In recent years, vanadium redox flow batteries (VRFBs) have emerged as a promising solution for large-scale energy storage, particularly in the renewable energy sector.

About Invinity / Utility-Grade Energy Storage

Our vanadium flow batteries unlock low-cost, low-carbon renewable energy on demand, delivering clean energy for generations to come. Invinity was created to address the large and rapidly

Top 10 Companies in the All-Vanadium Redox Flow Batteries

Jun 9, 2025 · In this analysis, we profile the Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry —technology innovators and project developers who are commercializing

Here''s the Top 10 List of Flow Battery Companies

4 days ago · Discover Sumitomo Electric''s advanced Vanadium Redox Flow Battery (VRFB) technology - a sustainable energy storage solution designed for grid-scale applications. Our

Vanadium Redox Flow Battery (VRFB) Companies

Need More Details on Market Players and Competitors? This report lists the top Vanadium Redox Flow Battery (VRFB) companies based on the 2023 & 2024 market share reports. Mordor

Vanadium Redox Flow Battery (VRFB) Companies

This report lists the top Vanadium Redox Flow Battery (VRFB) companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research

6 FAQs about [Portonovo Vanadium Flow Battery Company]

What is a vanadium flow battery system?

Vanadium flow battery systems are ideally suited to stabilize isolated microgrids, integrating solar and wind power in a safe, reliable, low-maintenance, and environmentally friendly manner. VRB Energy grid-scale energy storage systems allow for flexible, long-duration energy storage with proven high performance.

Who makes vanadium redox flow batteries in China?

V-LIQUID in flow battery manufacturers in China has been engaged in the R&D and production of vanadium redox flow batteries since 2016, and the complete integration of new energy power generation such as photovoltaics. The vanadium redox flow battery developed and manufactured by V-LIQUID has the following technical characteristics:

What are vanadium redox flow batteries mainly used for?

Due to their relative bulkiness, vanadium flow batteries are mainly used for grid energy storage. Also known as the vanadium redox battery (VRB), the vanadium redox flow battery (VRFB) has vanadium ions as charge carriers.

Can flow battery energy storage be integrated with KW-MW-class vanadium flow battery?

Shanghai Electric Energy Storage in flow battery manufacturers in China has successfully developed 5kW/25kW/32kW series stacks, which can integrate kW-MW-class vanadium flow battery energy storage products. Up to now, more than 30 kW-MW level flow battery energy storage projects have been successfully implemented.

Which company has installed the largest redox flow battery in Europe?

In 2014 Vanadis has installed the largest European Flow Top companies for Vanadium Redox Flow Battery at VentureRadar with Innovation Scores, Core Health Signals and more.

Who is the best flow battery manufacturer in China?

One of the top 10 flow battery manufacturers in China, HBIS has researched and prepared high-purity and high-performance vanadium redox flow battery electrolyte with low impurity content, high product stability and low production cost, and has developed more than 10 mature processes.

Update Information

- Liquid Flow Battery Company

- Vanadium Redox Flow Battery Purchase

- Spanish communication base station flow battery construction company

- Operating voltage of vanadium liquid flow battery

- Vanadium flow battery fluid standards

- Vanadium liquid flow battery effect

- What is vanadium liquid flow battery

- Vanadium Liquid Flow Battery Metal Research Institute

- Advantages and disadvantages of vanadium flow battery

- Vanadium Redox Flow Battery Maintenance

- Flow battery manufacturing company

- Brussels communication base station flow battery construction company

- China bess battery storage for sale company

Solar Storage Container Market Growth

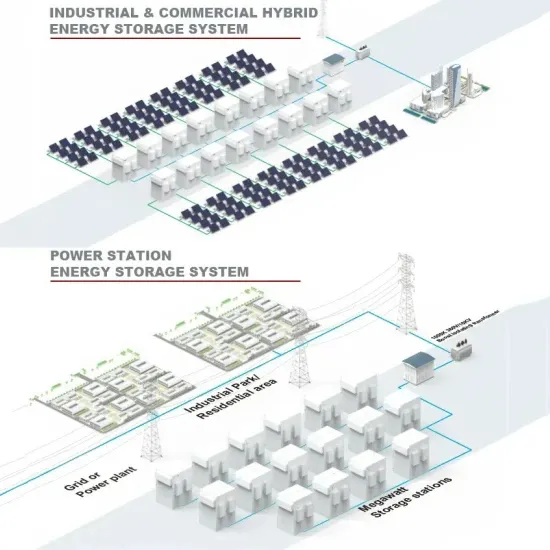

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.