ASEE–ASEAN Smart Energy & Energy Storage

ASEE–ASEAN Smart Energy & Energy Storage Expo มหกรรมพลังงานอัจฉริยะและการจัดเก็บพลังงานแห่งอาเซียน

Decarbonisation of ASEAN Energy Systems: Optimum

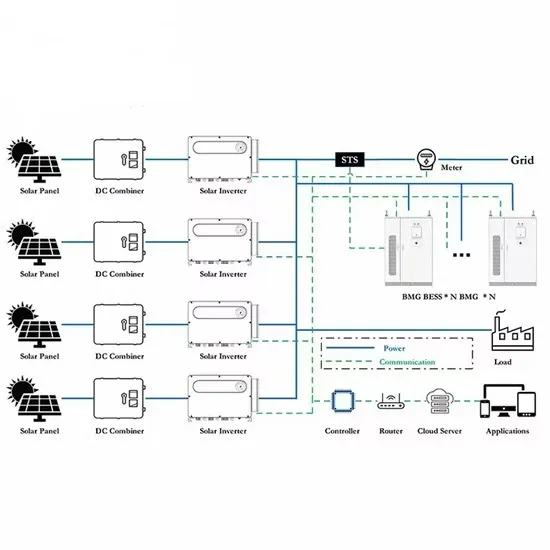

The model includes low-carbon technologies, such as solar photovoltaic (PV) power generation, onshore and offshore wind power generation, hydrogen (H2)-fired power generation, ammonia

A decade of solar PV deployment in ASEAN: Policy landscape

Nov 1, 2022 · Further, there is a global trend of energy transition from a carbon-based to a greener energy system. Hence, ASEAN countries look forward to decentralized and

Vietnam eyes doubling of power generation capacity by 2030 – ASEAN

UAE-based energy company Masdar and PLN Nusantara Power (PLN NP) have reached an agreement to expand phase II of the Cirata floating photovoltaic (FPV) power plant in

Top 10 Energy Storage Companies in Asia

Jul 14, 2025 · Explore our list of the top energy storage companies in Asia, driving the continent''s renewable energy revolution. ENGIE UK is a utility company and Independent Power Producer

REV1-PB-Mapping the Current State of Electrical Safety

Sep 24, 2024 · The integration of renewables, such as solar photovoltaic (PV), wind, and emerging technologies like battery energy storage systems (BESS), into the ASEAN energy

ASEE–ASEAN Smart Energy & Energy Storage Expo

ASEE–ASEAN Smart Energy & Energy Storage Expo มหกรรมพลังงานอัจฉริยะและการจัดเก็บพลังงานแห่งอาเซียน

ASEAN Smart Energy & Energy Storage Expo 2026: IMPACT

Apr 2, 2025 · ASEAN Smart Energy & Energy Storage Expo 2026: Overview Join us at the ASEAN Smart Energy & Energy Storage Expo 2026, where industry pioneers from Asia

Building an Energy Storage Business in ASEAN

Sep 17, 2021 · The Philippines has the most open electricity market and some of the strongest potential drivers including RE, high electricity prices, population off grid, and regulatory support

supplies Southeast Asia''s largest battery energy storage system

Dec 21, 2023 · UAE-based energy company Masdar and PLN Nusantara Power (PLN NP) have reached an agreement to expand phase II of the Cirata floating photovoltaic (FPV) power plant

ASEAN (Bangkok) Solar PV & Energy Storage Expo 2025

Mar 5, 2025 · The ASEAN (Bangkok) Solar PV & Energy Storage Expo 2025 will be held in Bangkok, the vibrant capital city of Thailand, which serves as a gateway to the booming

Southeast Asia''s emerging energy storage opportuniti

Dec 17, 2022 · Wärtsilä has delivered a number of projects in the region, including Singa-pore''s first-ever pilot grid-scale battery energy storage system (BESS) and several large-scale

ASEAN PLAN OF ACTION FOR ENERGY COOPERATION

Apr 26, 2023 · The Heads of ASEAN Power Utilities and Authorities (HAPUA), as a Specialised Energy Body (SEB), drives the APG to ensure regional energy security in collaboration with

China s New Energy Enterprises Going Abroad Series:

Aug 1, 2025 · The inherent intermittency and instability of power generation from new energy sources such as wind and solar energy will accelerate the rapid development of the global

Indonesia state power company in energy storage, green

UAE-based energy company Masdar and PLN Nusantara Power (PLN NP) have reached an agreement to expand phase II of the Cirata floating photovoltaic (FPV) power plant in

ASEAN Solar PV and Energy Storage Expo 2025: IMPACT

Aug 7, 2024 · ASEAN Solar PV and Energy Storage Expo 2025: Overview ASEAN Solar PV and Energy Storage Expo 2025 is a premier event dedicated to the advancement of solar

Virtual battery storage service using hydropower plant with

Despite the variability in the output, solar photovoltaic installations have steadily increased around the globe. To ensure the scheduled PV power output and reliability, the system should be grid

6 FAQs about [ASEAN Energy Storage Photovoltaic Power Generation Company]

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

How is ASEAN transforming its energy landscape?

The ASEAN region is witnessing a significant transformation in its energy landscape, driven by ambitious renewable energy storage targets and the need for grid modernization.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

How much solar power does Vietnam need?

of typical solar deployment for the whole ASEAN region.Wärtsilä said in its power system study that Vietnam needs about 7GW of balanc-ing capacity that could be provided by flexible engine power plants by 2030, and about 1GW of energy storage by 2035. “Because each country has diferent access, for instance, to natural res

Why is the Philippines a leader in battery energy storage?

The country's leadership position is driven by its progressive energy policies and ambitious renewable energy integration goals. The Philippines has established itself as a pioneer in battery energy storage system (BESS) deployment, with multiple large-scale projects under development across its various islands.

What is Aster renewable doing in Vietnam?

Aster Renewable is developing over 500MW wind power generation projects in Vietnam. Commitment by the Vietnam government to COP26 has also significantly enlarged the space for renewable development in this fast-growing country.

Update Information

- ASEAN Photovoltaic Energy Storage Power Generation

- Haiti Energy Storage Photovoltaic Power Generation Unit

- Photovoltaic energy storage cabinet photovoltaic power generation

- Photovoltaic power generation must have energy storage

- Bangui price photovoltaic energy storage power generation

- Oceania communication base station flywheel energy storage photovoltaic power generation efficiency

- Energy storage photovoltaic power generation enterprises

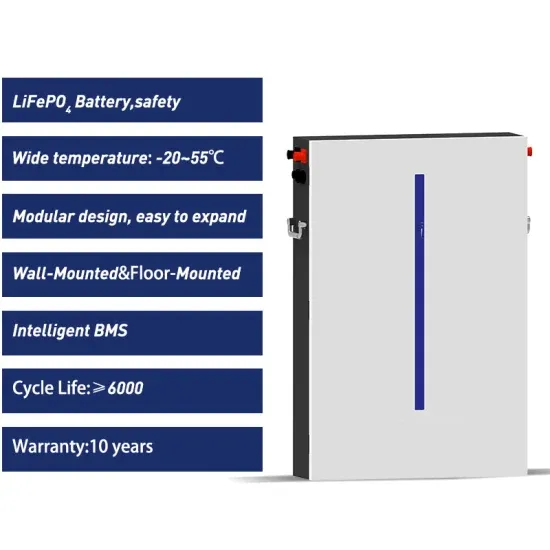

- Photovoltaic power generation energy storage battery configuration parameters

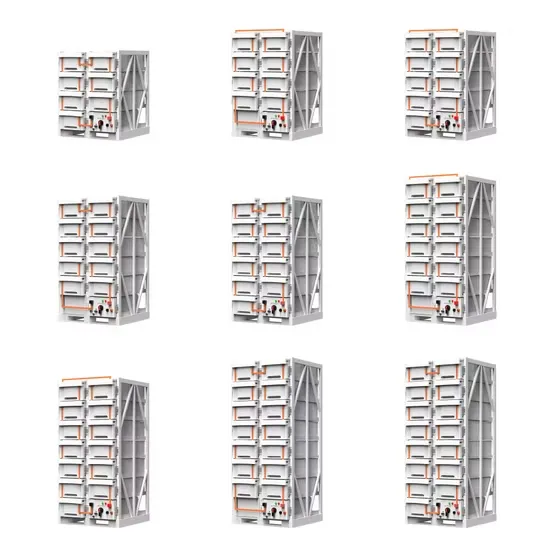

- Photovoltaic power generation energy storage container

- Algeria s photovoltaic power generation and energy storage advantages

- Photovoltaic panels for energy storage and power generation

- Energy Storage Power Generation System Company

- Photovoltaic power generation and energy storage manufacturer in Brno Czech Republic

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.