Brazilian Energy Storage Companies: Powering the Future

Jan 2, 2022 · Brazilian energy storage companies are stepping into the spotlight, tackling everything from solar power gaps to Amazon rainforest microgrids. With a $33 billion global

Brazil''s Solar Boom: Why Energy Storage is Key for

Jun 19, 2025 · Explore Brazil''s 19.2GW solar growth in 2025 and why battery storage is crucial for businesses. Learn about DG opportunities, new regulations, and how DLCPO''s lithium

Top 49 Battery Suppliers in Brazil (2025) | ensun

With 20 years of experience, the company ensures reliable and sustainable energy storage for various sectors, including solar power systems, telecommunications, and emergency lighting.

Officials warn of grid collapse amid blackouts in

Apr 8, 2024 · An aerial view of Sao Paulo. Credit: stocklapse via Getty Images. São Paulo, Brazil''s financial and economic centre, is facing widespread

Storage will be key to modernizing Brazil''s

Dec 9, 2024 · The Brazilian energy storage market will be one of the main pillars of the national plan to update the country''s electricity sector. This was one of

Energy Storage Companies in Brazil: Key Players, Trends, and

Jun 25, 2022 · With solar capacity hitting 4GW+ in Q1 2025 alone [5], the country''s energy storage sector is booming faster than a Carnival parade. This article dives into the top energy

Matrix Energia enables storage-as-a-service for

Aug 28, 2024 · To unlock new business in battery energy storage, São Paulo-headquartered Matrix Energia is betting on a model that has been successful

Top 7 Brazilian Solar Lithium Battery Suppliers | 2025 Guide

Mar 13, 2025 · Discover Brazil''s top solar lithium battery suppliers for 2025. Compare trusted Brazilian manufacturers of renewable energy storage solutions

Top Battery Energy Storage Testing Institutions in São Paulo Brazil

As Brazil accelerates its renewable energy adoption, battery storage systems are critical for stabilizing grids powered by solar and wind. São Paulo, a leader in Brazil''s clean energy

Top 100 Energy Storage Companies in Brazil (2025) | ensun

EcoPower is a leading company in the solar energy sector, specializing in the installation of solar power systems that can integrate energy storage solutions like batteries to provide power

13 Top Solar Companies in Brazil · August 2025 | F6S

Aug 1, 2025 · Detailed info and reviews on 13 top Solar companies and startups in Brazil in 2025. Get the latest updates on their products, jobs, funding, investors, founders and more.

São Paulo School of Advance Science on Renewable Energies

Jul 23, 2018 · Among the available sources, solar energy, biomass, hydroelectric, wave, tidal, geothermal and wind power can substitute the traditional sources of oil, gas and coal

São Paulo inaugurates floating photovoltaic plant at the

Dec 20, 2024 · The completion of the works is scheduled for the end of 2025, with investments of R$ 450 million.The State of São Paulo inaugurated and delivered the first stage of

Globo Brazil to open 180MW PV factory in São Paulo

Aug 26, 2015 · Brazil''s largest solar panel manufacturing facility will be inaugurated on Friday (28 August) by manufacturer Globo Brazil, providing a major boost towards financing domestic PV

6 FAQs about [Solar cell energy storage company in Sao Paulo Brazil]

What are the top 10 energy storage companies in Brazil?

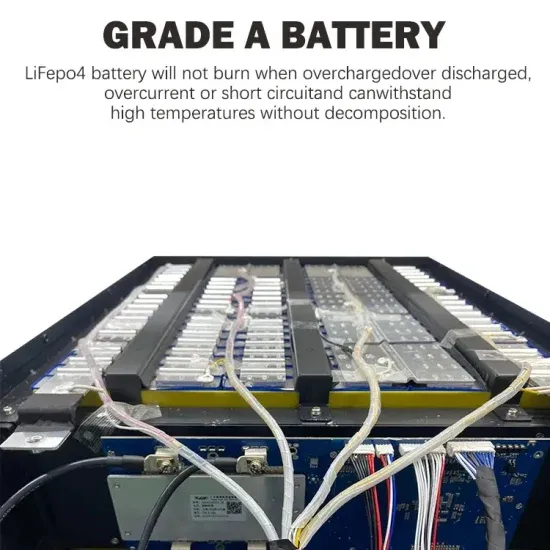

Due to various incentives and policies, Brazil's optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage companies including Baterias Moura, BYD, Freedom Won, Blue Nova Energy, Intelbras, Huntkey, FIMER, SMA Solar, Sungrow, and SolarEdge.

Where is Moura solar located?

It is one of the largest energy storage system suppliers in Brazil. Moura Solar was developed by Acumuladores Moura and Neosolar and is Brazil’s first commercial photovoltaic + energy storage project. It is located in the state of Pernambuco in northeastern Brazil.

Where is Brazil's first commercial wind power & energy storage project located?

In March 2021, Acumuladores Moura and Baterias Duran jointly developed Brazil’s first commercial wind power + energy storage project and put it into operation. It is located in the state of Bahia in northeastern Brazil, with a total capacity of 1.5MW/3MWh, aiming to provide local Agricultural irrigation provides stable and clean energy.

Who is the largest battery supplier in Brazil?

BYD (002594.SZ) is Brazil’s largest battery supplier and has two factories in Brazil, producing lithium-ion batteries and solar modules respectively. BYD will start producing new N-type TOPCON photovoltaic modules in Brazil in December 2022, with a power capacity of 575W.

What industry is solar a part of?

Solar forms part of the Energy industry, which is the 14th most popular industry and market group. If you're interested in the Energy market, also check out the top Energy & Cleantech, Renewable Energy, Recycling, Oil & Gas or Energy Efficiency companies. A startup focused on delivering a unique energy bill experience

Why is the optical storage market growing in Brazil?

Driven by various incentives and related active policies in recent years, Brazil’s optical storage market has experienced strong demand, and its installed capacity has experienced rapid growth. Brazil added 8.2GW of distributed power generation capacity and 2.5GW of centralized power generation capacity.

Update Information

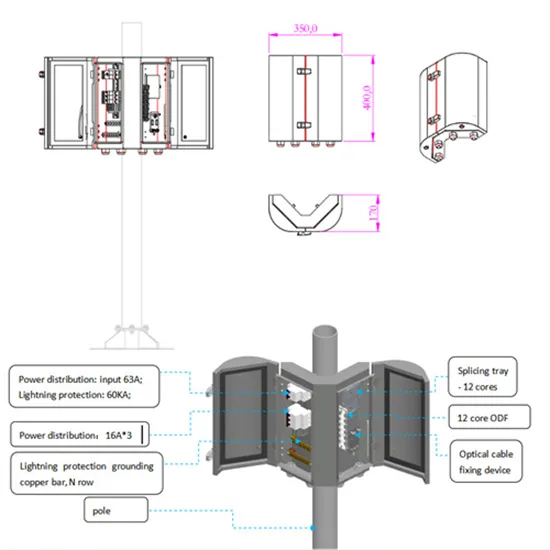

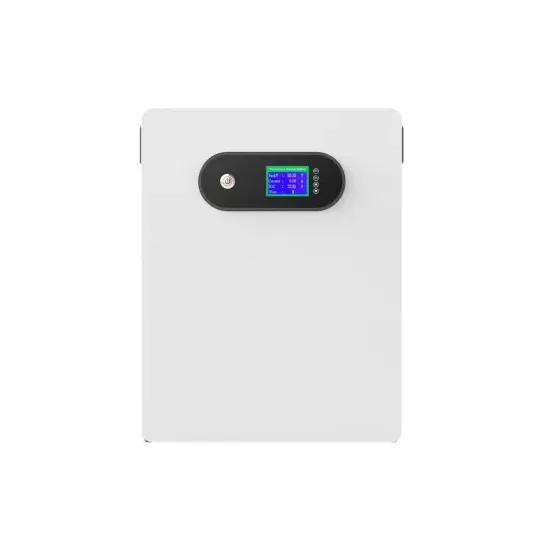

- Sao Paulo Brazil Smart Energy Storage Battery Customization Company

- Sao Paulo Brazil Energy Storage Power Plant Factory

- Which solar energy storage company is best in the Marshall Islands

- Solar power supply system in Sao Paulo Brazil

- Taipei Solar Energy Storage Company

- Bahrain communication base station solar cell energy storage cabinet

- Communication base station solar energy storage inverter company solar thermal equipment

- Solar cell capacitor energy storage

- Sao Tome and Principe EK solar energy storage charging pile

- Brazil Sao Paulo backup power storage application site

- Solar energy company photovoltaic cell components

- Eastern European Solar Power Generation and Energy Storage Company

- Solar energy storage containers are cheap to buy

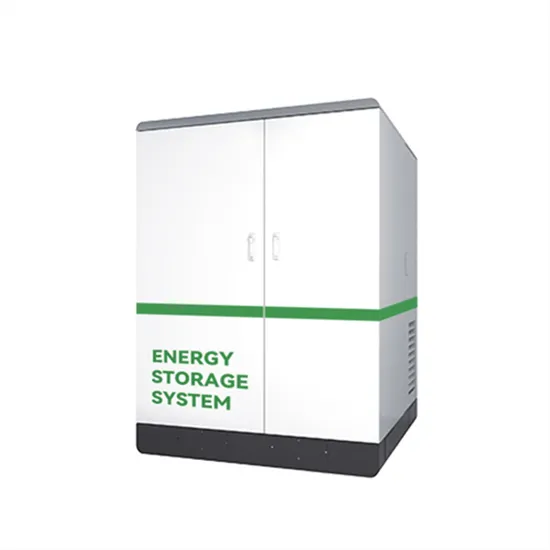

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.