Twenty20 Energy to Build First-of-its-Kind "Power Island" FSRP in Papua

Jul 11, 2022 · SINGAPORE-- (BUSINESS WIRE)-- Twenty20 Energy, which delivers innovative energy solutions that accelerate the transition to a cleaner energy future, today announced

NATIONAL ENERGY POLICY 2017

Sep 25, 2020 · 13 Papua New Guinea has huge hydro power potential, currently estimated at 15.000MW1, which if developed, could significantly boost PNG''s energy production potential.

Papua New Guinea distributed energy storage cabinet

Papua New Guinea | Efficient Distributed Generation Clarke Energy is the authorised distributor and service provider for INNIO''''s Jenbacher gas engines in Papua New Guinea, currently

Papua New Guinea energy storage charging pile

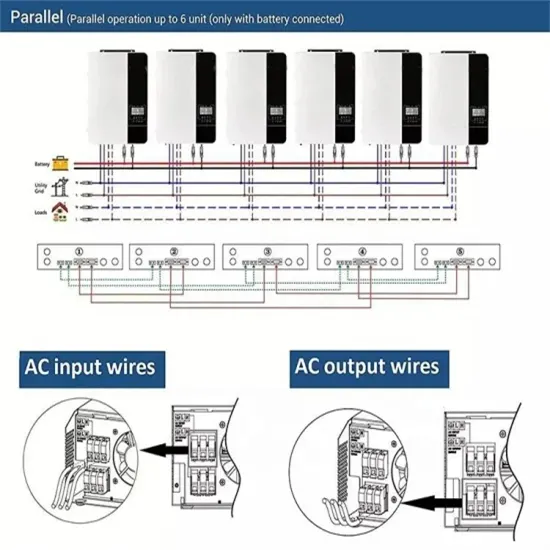

This paper introduces a DC charging pile for new energy electric vehicles. The DC charging pile can expand the charging power through multiple modular charging units in parallel to improve

Papua New Guinea distributed energy storage cabinet

Clarke Energy is the authorised distributor and service provider for INNIO''''s Jenbacher gas engines in Papua New Guinea, currently serving the country from our Australian-based South

Papua New Guinea Laboratory Battery Model

What is Gelion doing in Papua New Guinea? Gelion, an Australian zinc-bromide battery tech specialist, has agreed to deliver 100 MWh of energy storage to Mayur Renewables for clean

Papua New Guinea Battery Energy Storage System Market

Papua New Guinea Battery Energy Storage System Competitive Benchmarking By Technical and Operational Parameters Papua New Guinea Battery Energy Storage System Company Profiles

Wärtsilä to Improve Reliability and Sustainability

Apr 17, 2025 · The technology group Wärtsilä has been awarded a turnkey contract to supply a 58MW power plant in Papua New Guinea in partnership

6 FAQs about [Papua New Guinea Energy Storage Power Distribution Company]

What does Pacific Energy do for Papua New Guinea?

Pacific Energy has acquired the Shell assets in 2010 to supply the Port Morseby International Airport. The Pacific Energy Group plays a key role in the international supply of Papua New Guinea. 2 new tanks will be commissioned in 2017 in order to optimize and extend our storage capacities and better serve our clients.

Where does PNG Power buy power?

emented. Currently PNG Power purchases power from the Hanjung Power Ltd, which supplies 24MW of electricity from its power station at Kanudi to supplement the supply from PNG Power’s stations at Rouna and Moitaka for the National Capital District’s loa

Who is PNG Power Limited (PPL)?

lations.PNG Power Limited (Company No 1-44680) was corporatised under Section 3 (1) of the Electricity Commission (Privatisation) Act 2002 as the successor company to the Papua New Guinea Electricity Commission (ELCOM). All of ELCOM’s assets, liabilities, rights, titles and personnel were transferre eportingPPL is a State Owned Enti

What is the main source of electricity in PNG?

eration.PNG Power’s main source of generation is hydro, which accounts for 70% of the total electricity ge eration. Generation by light fuel oil is 14% and an Independent Power Pro-ducer (IPP) ith 16%. Current annual generation is ove

What is the power supply capacity of PNG?

um term.PNG Power has an installed generation capacity of ov r 300MW. Of this, hy ro powerstations account for 70% and thermal account for 30% of the total apacity. The transmis-sion voltages are 132kV, 66kV and 33kV, while the distribution voltages are 11kV a d 22 kV. The standard consumption voltages are 415 Volts and 240 Volts

Which Papua New Guinea provinces have LV distribution solutions?

TAG Energy has installed HV | LV Distribution solutions in most of Papua New Guinea’s provinces and districts, specifically the Southern Highlands Province, Western Highlands Province, Central Province, East New Britain, Autonomous Region of Bougainville, Samarai Murua District, Popondetta, and the National Capital District.

Update Information

- Ranking of Energy Storage Container Power Stations in Papua New Guinea

- Equatorial Guinea Energy Storage Power Company Branch

- What does PV energy storage swap mean in Papua New Guinea

- Papua New Guinea s communication base station energy storage battery

- Papua New Guinea Smart Energy Storage Battery Enterprise

- Kenya New Energy Battery Storage Box Company

- Riyadh New Energy Company Energy Storage

- Which new energy storage company is best in Apia

- Myanmar Energy Storage Power Station Manufacturing Company

- Russia St Petersburg Multifunctional Energy Storage Power Company

- New energy storage power station and its operation

- Design of a new energy storage power station in Sri Lanka

- Mongolia s new energy power generation supporting energy storage

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.