5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Which RF Technologies Are Shaping 5G Base Stations?

Apr 24, 2025 · At the heart of this revolution lies a complex infrastructure powered by advanced radio frequency (RF) technologies. Among all the components that build a 5G network, RF

Lockheed Martin prepares first 5G.MILR payload for orbit

Nov 13, 2023 · Lockheed Martin is one step away from showcasing how its 5G.MIL® capability can reach all domains around the world. In its final successful lab demonstration, the company

Altice Dominicana commences 5G deployment

Dec 1, 2021 · In October, regulator Indotel (Instituto Dominicano de las Telecomunicaciones / Dominican Telecommunications Institute) confirmed that its tender of 5G-capable spectrum

5G RAN Architecture: Nodes and Components

Jan 24, 2023 · Discover 5G RAN and vRAN architecture, its nodes & components, and how they work together to revolutionize high-speed, low-latency wireless communication.

Dominican Republic Telecom

Apr 13, 2021 · There are likely opportunities for U.S. companies to provide 5G-related equipment, like core network components and radio access components such as base stations and

China''s strides in advancing 5G development

Jun 6, 2024 · Today, with over 3.7 million 5G base stations installed nationwide, the large-scale application of 5G in China has greatly benefited both individuals and businesses, bringing

Comprehensive Plan for the Nationwide Rollout of 5G

Dec 12, 2024 · Thereafter, the 5G services were launched on 01st October 2022. As on 31st Oct 2024, 5G services have been rolled out in all States/ UTs across the country and presently 5G

Dominica 5G Network Infrastructure Market (2025-2031)

Dominica 5G Network Infrastructure Industry Life Cycle Historical Data and Forecast of Dominica 5G Network Infrastructure Market Revenues & Volume By Component for the Period 2021-2031

Chart: Where 5G Technology Has Been Deployed

Jul 27, 2022 · Approximately 15 more have had 5G mobile technology deployed in part. It is expected that 5G will reach 1 billion users this year after just in 3.5

China plans to upgrade its 5G network, accelerate 6G

Jan 6, 2025 · China will continue to accelerate the research, development, and innovation of 6G cellular technology and upgrade its 5G mobile network to reach 5G-A level in its new data

Is There 5G in Dominican Republic: Everything You Need to

Jul 11, 2024 · In the Dominican Republic, several telecom providers are offering 5G services to cater to the growing demand for faster and more reliable connectivity. Claro, one of the leading

Gobierno anuncia puesta en operación de

2 days ago · Santo Domingo.- El Instituto Dominicano de las Telecomunicaciones (Indotel) informó hoy la puesta en operación de manera oficial del servicio 5G

China''s Xinjiang now has over 10,000 5G base stations

China has taken a global lead in 5G development and completed the construction of the world''s largest 5G standalone network, with some 961,000 5G base stations built as of July 18.

6 FAQs about [Dominica Communications 5G base station completed]

Is Altice deploying 5G in the Dominican Republic?

Service Management Altice Dominicana has begun deploying its 3.5GHz 5G network in the Dominican Republic. According to CommsUpdate, the rollout was confirmed at a 5G innovation event in Santo Domingo by Altice Labs’ Head of Innovation and Technology Strategy Paulo Pereira.

How much did INDOTEL bid for 5G spectrum?

In October, regulator Indotel (Instituto Dominicano de las Telecomunicaciones / Dominican Telecommunications Institute) confirmed that its tender of 5G-capable spectrum raised over US$73 million. Altice Dominicana bid US$20.67m for a 70MHz block in the 3.4GHz-3.5GHz band, receiving its licence formally on 28 th October this year.

Will INDOTEL deliver 'flawless' 5G coverage in 2022?

The operator’s CEO Ana Figueiredo stated that the deployment would be carried out gradually, but would deliver “flawless” coverage from 2022. In October, regulator Indotel (Instituto Dominicano de las Telecomunicaciones / Dominican Telecommunications Institute) confirmed that its tender of 5G-capable spectrum raised over US$73 million.

When will 5G reach 1 billion users?

Approximately 15 more have had 5G mobile technology deployed in part. It is expected that 5G will reach 1 billion users this year after just in 3.5 years in use, compared with 4 years for 4G and 12 years for 3G. The Americas and Europe are on the forefront of 5G implementation, as our map shows.

Which country has the first 5G network?

South Korea is the country which deployed the first 5G network and is expected to stay in the lead as far as penetration of the technology goes, By 2025, almost 60 percent of mobile subscriptions in South Korea are expected to be for 5G networks.

Which countries are implementing 5G?

The Americas and Europe are on the forefront of 5G implementation, as our map shows. But investments in the technology have also been made in almost every country in Asia, with the technology also already deployed in many Asian countries.

Update Information

- Will Palau Communications build a 5G base station

- Serbia Communications 5G Base Station Frequency

- China Communications Services 5G Base Station

- China Communications 5g low power generation base station

- Grenada Communications 5g Experimental Base Station

- Andorra City Communications 5g micro base station

- Oceania Communications 5g base station 418KWh

- Investor of 5g base station construction of Niue Communications

- China Communications 5g base station equipment

- Does Stockholm Communications 5G base station support 1gb per second

- 5g base station communications industry

- Niue Communications 5g Base Station Airport

- Palau Communications 5g base station costs

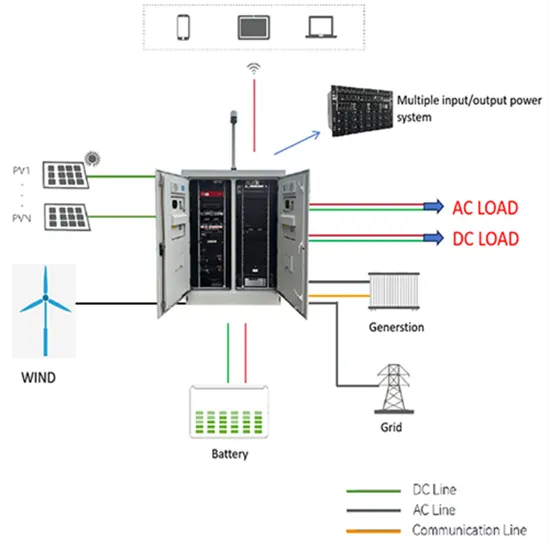

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.