SolarReviews Releases the 2023 ranking Solar Panel Manufacturers

Jan 31, 2023 · SolarReviews Ranks the Top 10 U.S. Solar Panel Manufacturers #1 Solar Panel Brand Qcells is assembled in the U.S.A. and boasts a 25-year product and performance

TOP 10 largest photovoltaic panel manufacturers in 2024

N-type panels dominate the market In 2024, the transformation of the panel and cell manufacturing industry gained momentum. N-type panels accounted for the majority of

Top Tier 1 Solar Panel Manufacturers List: Updated 2024

Mar 20, 2025 · Check out which solar module manufacturing companies made the 2024 Tier 1 Solar Panel List below. Interested in seeing which Tier 1 solar panels are currently available

JinkoSolar takes top spot on WoodMac''s list of

Jan 23, 2025 · Wood Mackenzie says that JinkoSolar has taken first place on its list of solar panel manufacturers. The report confirms the dominance of the

List of Top 10 Solar Panel Manufacturers in India

Feb 1, 2025 · List of Top 10 Solar Module Manufacturers in India · Adani Solar · Tata Solar Power · Bluebird Solar. Explore trusted solar companies known for

Australia''s top 10 most installed solar panels and

Feb 23, 2023 · Australian solar and storage research firm SunWiz has published a list of the country''s top solar panel and inverter manufacturers at the close of

6 FAQs about [Canberra s largest photovoltaic panel manufacturer]

What makes a top solar panel manufacturer in Australia?

Australia's Top Solar Panel Manufacturers Becoming a top solar panel manufacturer in Australia takes a combination of factors, including innovation, quality, reliability, customer satisfaction, and sustainability.Innovation is key in the ever-evolving solar industry.

What services does a solar PV company offer in Canberra?

Inspection, cleaning, repair and optimisation of your existing solar PV system. We supply and install solar panels, micro inverters and batteries. We offer a range of services in Canberra and surrounding regions to help our customers take advantage of the benefits of solar energy.

Which are the top PV manufacturers in Australia?

BP Solar is one of the top PV manufacturers in Australia. They are headquartered in Victoria and have been a cost-effective and efficient solar power solution for the past few years. BP Solar offers residential, commercial, and industrial applications to their customers across the world.

How to become a top solar panel manufacturer in Australia?

Becoming a top solar panel manufacturer in Australia takes a combination of factors, including innovation, quality, reliability, customer satisfaction, and sustainability. Innovation is key in the ever-evolving solar industry. A manufacturer must constantly invest in research and development to stay ahead of the competition.

Which solar panel brands are the top brands in Australia?

This can involve using renewable energy sources, recycling materials, and reducing waste. How can SunWiz state with confidence these panel brands are the Top Brands in Australia? SunWiz is Australia’s primary source of market analytics for the Solar & Storage industry.

How many solar panels are installed in Australia?

Australia installs about 1,000 rooftop solar systems every day. Billions of dollars have been spent on these systems, which consist of silicon, glass, and metal. Given the high uptake of solar in Australia, you might expect that some of these panels are made here.

Update Information

- The largest photovoltaic panel manufacturer in Italy

- The largest photovoltaic panel manufacturer in Albania

- The largest photovoltaic panel manufacturer in Zagreb

- The largest photovoltaic panel manufacturer in Costa Rica

- Tajikistan rooftop photovoltaic panel manufacturer

- Rooftop photovoltaic panel manufacturer in Johannesburg South Africa

- Photovoltaic panel installation manufacturer in Liberia

- Uruguayan rooftop photovoltaic panel manufacturer

- Photovoltaic panel manufacturer in Ljubljana

- Wellington grid-connected photovoltaic panel manufacturer

- Photovoltaic panel manufacturer number

- Ukrainian photovoltaic panel custom manufacturer

- Monaco photovoltaic panel manufacturer

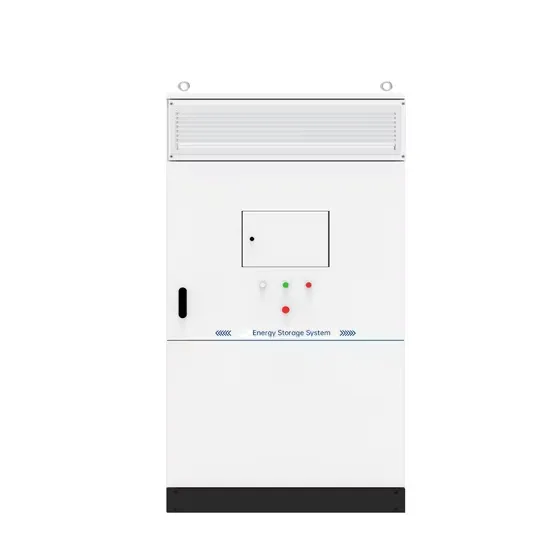

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.