AMPYR achieves Financial Close of Wellington Stage 1 BESS

AMPYR Australia (AMPYR) today announced it has achieved financial close of its 300 MW / 600 MWh Wellington Stage 1 battery energy storage system (BESS) project in regional New South

2025_AMPYR_Project_Factsheet_Wellington

Apr 8, 2025 · The Wellington Battery Energy Storage System (BESS) will store excess renewable energy ready for use by homes and businesses during peak times. BESS projects play an

Wellington Energy Storage Battery Cost Key Factors and

Understanding the cost of Wellington energy storage batteries is critical for businesses and homeowners transitioning to renewable energy. This article breaks down pricing components,

Fluence Chosen for 300 MW / 600 MWh Wellington Battery Energy Storage

Jul 8, 2025 · Fluence (NASDAQ: FLNC) has been selected by AMPYR Australia for the 300 MW / 600 MWh Wellington Stage 1 Battery Energy Storage System (BESS) project in New South

Ampyr Energy Global hunts investor for 400MW Wellington battery-energy

May 15, 2025 · Renewables developer Ampyr Energy Global wants a deep-pocketed investor for its 400MW Wellington battery-energy storage system in NSW, three months after buying out

Fluence Chosen for 300 MW / 600 MWh Wellington Battery Energy Storage

Jul 7, 2025 · Fluence Chosen for 300 MW / 600 MWh Wellington Battery Energy Storage System for AMPYR Australia The project will include the full suite of Fluence''s innovative storage

Ampyr seeks investors in gigawatt-scale battery

May 16, 2025 · Battery storage developer led by ISP lead Alex Wonhas seeks investors in first stage of planned gigawatt scale battery, as it also rolls out

2025_AMPYR_Project_Factsheet_Wellington

Apr 8, 2025 · Wellington Battery The Wellington Battery Energy Storage System (BESS) will store excess renewable energy ready for use by homes and businesses during peak times. BESS

Wellington South Battery Energy Storage System | Planning

2 days ago · I object to this Battery Energy Storage System because it is a part of the fake green RenewaBULL Energy Transition - that is the most scandalous, idiotic rip-off of Australian

Wellington South Battery Energy Storage System

Aug 12, 2025 · AMPYR Australia Pty Ltd (AMPYR) and Shell Energy (Shell) propose to develop the Wellington Battery Energy Storage System (the project). The project involves the

Wellington South Battery Energy Storage System

Feb 23, 2024 · The project incorporates a large-scale battery energy storage system (BESS) with a discharge capacity of 500 megawatts (MW), along with connection to the Wellington

Herbert Smith Freehills Kramer advises lenders on 300 MW /

Jul 17, 2025 · Herbert Smith Freehills Kramer (HSF Kramer) has advised a syndicate of lenders on the project financing of AMPYR Australia''s 300MW/600MWh Wellington Battery Energy

Wellington Energy Storage Station: The Giant Battery

With global energy storage capacity projected to hit 1.2 TWh by 2030 [3], the Wellington facility isn''t just big – it''s strategically big. Here''s what makes it click-worthy:

6 FAQs about [Wellington Energy Storage Battery]

What is the Wellington Battery energy storage system (BESS)?

The Wellington Battery Energy Storage System (BESS) is planned to be developed in the central west New South Wales (NSW), Australia. The project will comprise a grid-scale BESS with a total discharge capacity of around 400MW. AMPYR Australia, a renewable energy assets developer in the country, owns 100% of the BESS project.

Where is Wellington South Battery energy storage system being developed?

Wellington South Battery Energy Storage System is being developed in NSW, Australia. (Credit: Sungrow EMEA on Unsplash) The Wellington Battery Energy Storage System (BESS) is planned to be developed in the central west New South Wales (NSW), Australia. The project will comprise a grid-scale BESS with a total discharge capacity of around 400MW.

Which is the largest battery storage project in NSW?

This will make Wellington BESS one of the largest battery storage projects in NSW. Wellington is being constructed at 6773 and 6909 Goolma Road, Wuuluman NSW 2820. The project site is situated within the Central-West Orana Renewable energy Zone (CWO REZ), in the Dubbo Regional Council local government area (LGA).

Where is the Wellington Battery located?

The existing Wellington substation is very strategically located within the NSW energy grid. The output from both stages of the Wellington Battery represents the demand from over 60,000 homes. This fund has been established with Dubbo Regional Council (DRC), allocating $2 million to the local community over the Battery’s life.

How long will it take to build the Wellington Battery?

Plans for construction of Stage 2 are ongoing, but construction is likely to follow 12 to 18 months behind Stage 1. The existing Wellington substation is very strategically located within the NSW energy grid. The output from both stages of the Wellington Battery represents the demand from over 60,000 homes.

What is the target capacity of the Wellington Bess?

The target capacity of the Wellington BESS is 500 MW / 1,000 MWh, making it one of the largest battery storage projects in NSW. The Wellington BESS will connect to the adjacent TransGrid Wellington substation, adjacent to the Central West Orana Renewable Energy Zone (Central West Orana REZ).

Update Information

- Wellington Energy Storage Battery Enterprise

- Wellington Energy Storage Battery

- Chisinau local energy storage battery model

- Battery life of independent energy storage power station

- Central Asian battery energy storage manufacturer

- Energy storage battery types in 2025

- Is the energy storage cabinet a carbon battery

- Energy storage cabinet environmental protection battery price inquiry

- The world s largest battery energy storage station

- Energy storage battery cabinet fire protection acceptance specification

- Energy storage battery charging solution

- Botswana Solar Energy Storage Battery Project

- Sodium-ion battery energy storage benefits

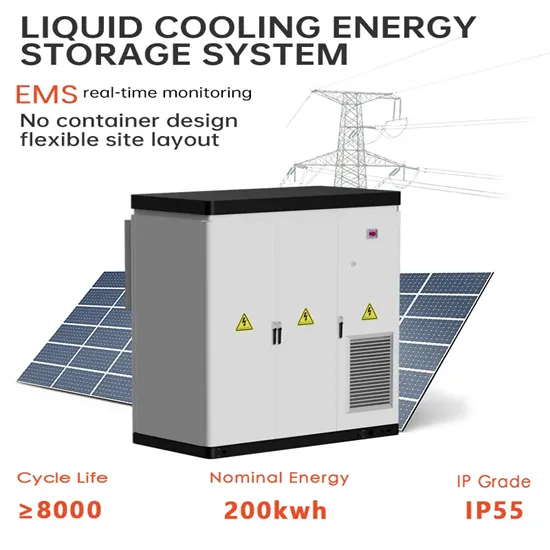

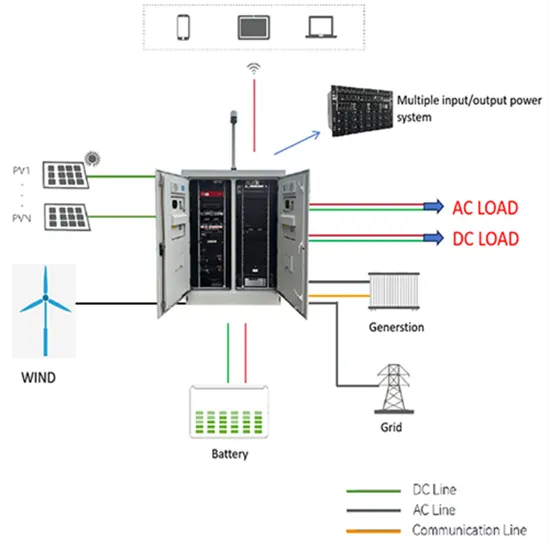

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

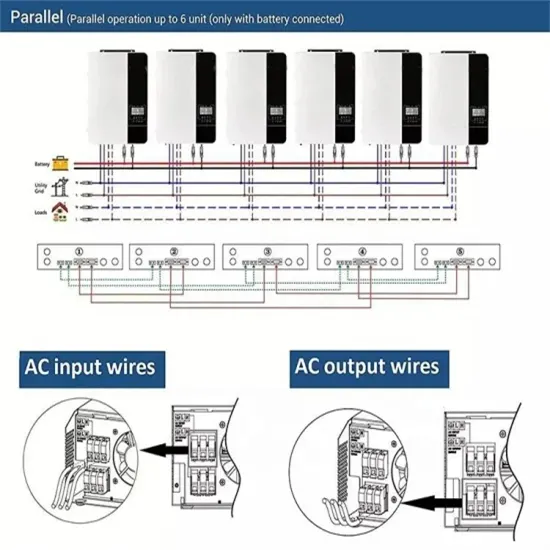

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.