Electric Power Tools Manufacturers Colombia, Electric Power

Machinesequipments is a Electric Power Tools Manufacturers in Colombia, Electric Power Tools Colombia, Electric Power Tools Suppliers Colombia and Exporters in Colombia for Electric

Colombia Power Equipment Market (2025-2031) | Trends

6Wresearch actively monitors the Colombia Power Equipment Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Outdoor Substations up to 400 kV Manufacturers Colombia, Outdoor

You can contact us by email at sales@machinesequipments for reliable Outdoor Substations up to 400 kV supplier, we are well-known for our world-class Outdoor Substations up to 400

Where to Buy | Westinghouse Outdoor Equipment

Find out where to purchase our products at one of our authorized retailers below. We encourage only buying from our trusted retailers to guarantee the best service and full warranty coverage.

Best 18 Power Equipment Repair in Fulton, IN

Outdoor Power Equipment Sales Repair in Fulton on superpages . See reviews, photos, directions, phone numbers and more for the best Outdoor Power Equipment-Sales & Repair in

Power Equipment & Trailer Dealership l Macon Outdoor Power

Macon Outdoor Power is a family-owned retail and service repair store focused on customer satisfaction! Our core business involves the sales and service of outdoor power equipment

Outdoor Power Plus Brand Asset — Russo Power Equipment

Russo Power Equipment is a multi-brand outdoor power equipment dealer and known for our commitment to customer service in our expert sales, service, and parts departments as well as

Colombia: Outdoor Equipment Market

The report covers outdoor equipment (tools, gear, and accessories, designed to provide comfort and safety for people who enjoy outdoor activities and adventures; including: tents, shelters,

Outdoor Power Equipment Business for Sale East Auckland

Why buy this Outdoor Power Equipment Business Outdoor Power Equipment Business for Sale East Auckland This business is iconic in its community, servicing the local customer base for

Industrial Electrification Manufacturers Colombia, Industrial

Machinesequipments is a Industrial Electrification Manufacturers in Colombia, Industrial Electrification Colombia, Industrial Electrification Suppliers Colombia and Exporters in

Power Equipment | See Full Import/Export History

Government records and notifications available for Power Equipment in Colombia. See their past export from Abc Plantas Y Equipos S A, an exporter based in Colombia. Follow future shipping

6 FAQs about [Selling outdoor power supplies in Colombia]

How can a foreign company get a distributor in Colombia?

To secure an agent, representative, or distributor, the foreign company must execute a contract that meets the provisions of the Colombian Commercial Code. This contract must be registered with the Chamber of Commerce in the city where the agent/representative is located. Agency or representation agreements do not require government approval.

How to organize a business in Colombia?

There are three common forms of organizing your business in Colombia: a corporation, a limited liability partnership, and a branch or subsidiary of a foreign corporation. U.S. firms should obtain legal and tax related advice from a Colombian law firm or accounting firm.

Are contraband products available in Colombia?

Consumer products from around the globe are available in Colombia at acceptable price levels. Under-invoicing of goods (usually of Chinese origin) and contraband articles sold at deep discounts remain a problem for legitimate retailers. The Colombian government has attained encouraging results in its effort to reduce contraband.

Do foreign companies need legal representation in Colombia?

The one exception to this law is for sales to the government, which do require foreign bidders to have legal representation in Colombia. To secure an agent, representative, or distributor, the foreign company must execute a contract that meets the provisions of the Colombian Commercial Code.

Do foreign companies have to register in Colombia?

All companies (including branches of foreign companies domiciled in Colombia) must register themselves and their accounting books, including daily journal entries, balance sheet, meeting minutes, and other required documents by law in the Commercial Register of the Chamber of Commerce in the cities where they are located.

Why is direct marketing popular in Colombia?

Direct marketing is popular in Colombia. Its growth has been fueled by such factors as technological advances in printing and distribution, the spread of cable TV, the increased use of credit cards and flexible payment plans and changing lifestyles.

Update Information

- A shopping mall selling outdoor power supplies in Colon Panama

- Which shopping mall in London sells outdoor power supplies

- What are the famous brands of outdoor power supplies

- Small and medium-sized outdoor power supplies

- Which mall in India sells outdoor power supplies

- The difference between lithium batteries and outdoor power supplies

- More than 20 000 outdoor power supplies

- Disadvantages of existing outdoor power supplies

- Two outdoor power supplies

- What are the outdoor power supplies that cost between 300 and 500 RMB

- Where can I buy outdoor power supplies in Iran

- What are the ultimate outdoor power supplies

- Colombia custom made outdoor power supply

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

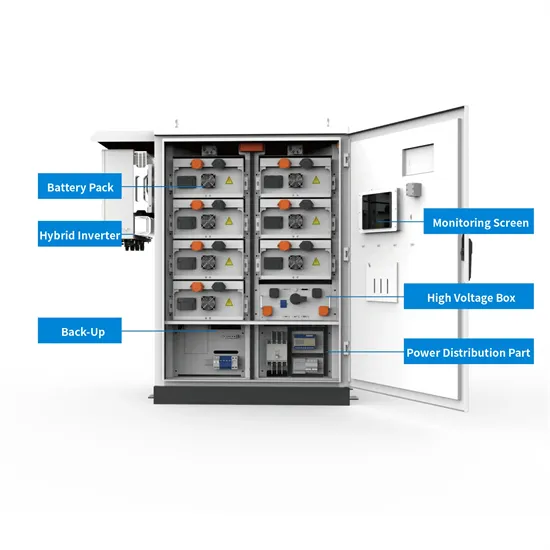

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.