European Inverter – Hybrid Solar Inverter & ESS Manufacturer

Jun 22, 2025 · High Frequency solar Inverter 4~6KW | PV 500V | MPPT 100A/120A | DC 24V,48V PV1900 EXP is a multi-function inverter/charger, combining functions of inverter, MPPT solar

Europe Solar Inverter Companies

This report lists the top Europe Solar Inverter companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these

Inverter manufacturers facing ''growing pains''

Nov 18, 2024 · The inverter market is experiencing "growing pains" as falling prices, shifting demand and technological product changes cause problems for the sector''s major Western

10 Best Brands and Models of Solar Panel

Jul 26, 2024 · A solar inverter, or solar panel inverter, is a pivotal device in any solar power system. Solar inverters efficiently convert the direct current (DC)

Analysis of Inverter Distribution Channels in Europe | EB BLOG

Oct 22, 2024 · Explore the dynamics of inverter distribution channels in Europe, including strategies, risks, and market trends shaping the future of the solar energy sector.

30kW Energy Storage Inverter Price Overview (2025 Update)

Jun 9, 2025 · High-End Brands (Europe & US): Price: $8,000 - $15,000 (¥58,000 - ¥109,000)Examples: , Siemens, SMA, FroniusFeatures: High certification, advanced grid

Eastern European Inverter Housing Prices Trends Costs Best

Why Eastern Europe Dominates Inverter Housing Manufacturing Eastern Europe has become a hotspot for inverter housing manufacturing, offering competitive prices without compromising

Eastern European Photovoltaic Power Generation Equipment Inverter

Solar Inverters Manufacturers In Europe Find the top Solar Inverters Manufacturers in Europe from a list including Solar Max, Kontron Solar GmbH, formely known as Steca Elektronik

Solar Energy Suppliers In Europe

Morningstar Corporation is a world-leading manufacturer and supplier of solar charge controllers & inverters. Since our inception in 1993, over three million Morningstar units have been

Top 5 inverter manufacturers in Europe

Jan 24, 2024 · The article provides profiles of the top five inverter manufacturers in Europe in 2024, which include Solaredge, Power Electronics, SMA, INGETEAM, and . Detailed

European Inverter – Hybrid Solar Inverter & ESS Manufacturer

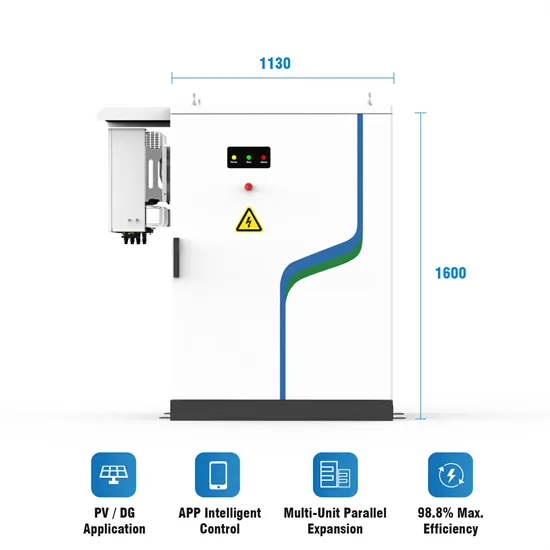

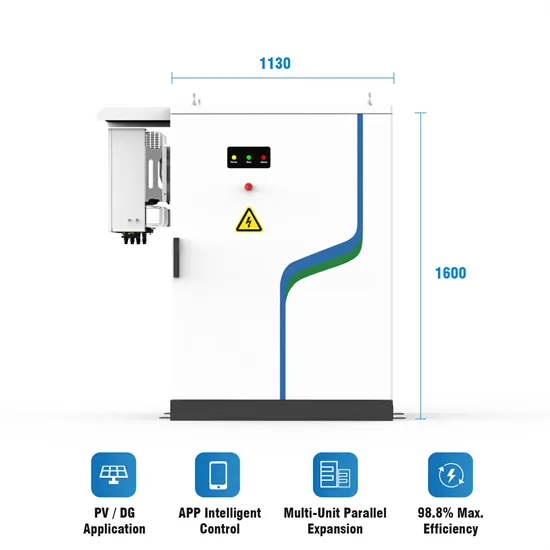

Jun 22, 2025 · PH1100 EU is brand new three phase hybrid inverter with low battery voltage 48V, ensuring system safe and reliable. With compact design and high-power density, this series

Zeversolar and Manitu Solar announce distribution partnership for

Nov 4, 2017 · Zeversolar, an inverter manufacturer from China and part of SMA since 2013, and Manitu Solar of Hungary, Budapest announced today that they have committed to a long-term

Slovakia s High-End Inverter Manufacturers Powering

In the heart of Europe, Slovakia has emerged as a hub for cutting-edge energy technology. This article explores how Slovakian high-end inverter manufacturers are reshaping industries

Solar Inverter Market Size, Trends & Forecast

Feb 25, 2025 · European Union The REPowerEU plan is intended to speed solar deployment to the conditions for a robust inverter market across the European

6 FAQs about [Eastern European high-end inverter manufacturer]

Who are the top 5 inverter manufacturers in Europe in 2024?

In conclusion, this article introduces the top 5 inverter manufacturers in Europe in 2024, namely Solaredge, Power Electronics, SMA, INGETEAM and . These top manufacturers have set high standards in the inverter manufacturing industry. As the demand for renewable energy continues to grow, the quality of the inverter cannot be ignored.

Who is a leader in Europe solar inverter market?

Schneider Electric SE, Siemens AG, FIMER SpA, Mitsubishi Electric Corporation and General Electric Company are the major companies operating in the Europe Solar Inverter Market. This report lists the top Europe Solar Inverter companies based on the 2023 & 2024 market share reports.

Which country is the largest solar inverter market in Europe?

In particular, Germany is expected to be a significant market for these companies due to its status as Europe's largest solar photovoltaic market. These corporations are also expected to benefit from trends such as an increase in larger solar PV installations. 1. COMPETITIVE LANDSCAPE Who are the key players in Europe Solar Inverter Market?

Which inverter is most popular in Europe?

Sales Statistics: Huawei has been expanding its presence in Europe, achieving around 18% market share in the commercial inverter segment with over 70,000 units sold in the first half of 2024. Key Features: The SUN2000 series is noted for its AI-driven energy management and is popular in large-scale commercial projects. 7. GoodWe DNS Series

What is the best hybrid inverter in Europe?

Sales Statistics: The REACT 2 has captured about 15% of the hybrid inverter market in Europe, with around 45,000 units sold in the first half of 2024. Key Features: This hybrid inverter is ideal for maximizing self-consumption with its integrated energy storage capabilities. 5. Fronius Primo Inverter

Why are inverters so important in Europe in 2024?

As a key component that converts the DC power stored by the battery into usable AC power, the inverter is critical to output efficiency. Europe, in particular, has seen a surge in demand for inverters due to its embrace of renewable energy. Here, we will highlight the top 5 inverter manufacturers in European in 2024.

Update Information

- China-Africa high-end inverter custom manufacturer

- Beirut high-end inverter custom manufacturer

- Qatar high-end inverter manufacturer

- Peru Arequipa high-end inverter custom manufacturer

- Rome 110kw high quality inverter manufacturer

- Dublin Standard Inverter Manufacturer

- Luanda three-phase inverter custom manufacturer

- Pretoria small power inverter manufacturer

- Port Vila lithium battery inverter manufacturer

- Inverter Manufacturer Power Supply

- Layoune RV dedicated inverter manufacturer

- Honduras three-phase inverter manufacturer

- Guinea-Bissau solar panel inverter manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.