Metlen expands further in Chilean market

Mar 6, 2025 · Metlen Energy & Metals continues to strengthen its position in Chile''s renewable energy sector with the successful signing of three new storage engineering, procurement, and

Chile Energy Storage Project Tender Announcement: What

Dec 3, 2024 · Let''s unpack the details, explore cutting-edge trends like hybrid storage systems and green hydrogen integration, and share tips to nail your bid. Key Dates and Requirements:

METLEN and Glenfarne seal deal for solar and battery energy storage

4 days ago · METLEN Energy & Metals and Glenfarne Asset Company announce the acquisition of a portfolio of solar and battery energy storage projects in Chile, with an installed capacity of

METLEN sells Chilean solar storage portfolio to Glenfarne

Apr 23, 2025 · METLEN Energy & Metals has announced the sale of its solar and BESS portfolio in Chile to Glenfarne Asset Company LLC, with a total capacity of 588 MW.

Chile Leads Latin America with the Largest Battery Energy Storage System

Chile has taken a significant step in the development of clean energy with the inauguration of the largest battery energy storage system (BESS) in Latin America. This milestone marks a pivotal

Abastible signs a long-term renewable energy

Mar 18, 2025 · The customized hybrid solution will provide night-time power to Abastible allowing it to better serve its customers The project, with 220 MWdc

Metlen sells 1.61 GWh of Chilean batteries as part of storage

Apr 25, 2025 · The battery energy storage systems (BESS) are under construction and their completion, due this year, will close the $815 million sale.

Grenergy Signs a New Agreement With BYD Energy Storage

May 22, 2025 · Grenergy has signed a new agreement with BYD Energy Storage, a global energy solutions provider, for the supply of 3.5 GWh in energy storage systems to be installed in the

Chile seeks multi-gigawatts of large-scale

Jun 6, 2023 · The government of Chile will launch a bill this year to procure large-scale energy storage systems for commissioning in 2026 totalling US$2 billion

Trina Storage ships 1.2-GWh batch to Chile | Energy Storage

Aug 11, 2025 · Trina Storage has shipped the first 1.2-GWh batch of its self-developed Elementa 2 battery energy storage system (BESS) to Chile, it announced on Monday.

Chile Energy Storage Industry Holds Promise | EMIS

Jun 5, 2024 · According to estimates of the national electric system of Chile (SEN) cited by Americas Market Intelligence, the country will have 13.2 GWh/ 2 GW (6–8-hour duration) of

Glenfarne to Acquire $815M Chilean Solar and Battery Storage

Apr 23, 2025 · The storage systems are currently under construction and expected to be operational within a year. The assets are geographically diversified with multiple

METLEN and Glenfarne Seal Landmark Deal for Solar and Battery Energy

Apr 25, 2025 · The partnership between METLEN Energy & Metals S.A. ("METLEN") and Glenfarne Asset Company, LLC ("Glenfarne") marks a significant milestone in the renewable

METLEN and Glenfarne seal landmark deal for Solar and Battery Energy

Apr 23, 2025 · METLEN Energy & Metals S.A. («METLEN») and a wholly owned subsidiary of Glenfarne Asset Company, LLC («Glenfarne») have entered into an agreement for Glenfarne

METLEN and Glenfarne Ink Landmark 588 MW Solar & Battery

Apr 25, 2025 · METLEN Energy & Metals S.A. has entered into an agreement with a wholly owned subsidiary of Glenfarne Asset Company, LLC ("Glenfarne") for the acquisition of a

6 FAQs about [Chile energy storage system for sale]

How many energy storage projects are in Chile?

According to a December 2023 publication on the InvestChile website, the country had 23 approved energy storage projects with a total of 3,000 MW of capacity. Chile is exploring a variety of solutions to keep abreast of the changing energy demand landscape ranging from BESS to innovative projects using CO2.

Will Chile be able to develop energy storage projects in 2024?

In 2022, Chile passed an energy storage and electromobility bill, which made stand-alone storage projects profitable, but the market is still expecting new rules on capacity payment for storage projects, which are to be approved in 2024. Chile has also put in place an auction procedure to award public land for the development of BESS projects.

Are battery energy storage systems a viable alternative for Chilean power producers?

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged as a profitable alternative for Chilean power producers.

Where are Chile's battery energy storage facilities located?

Chile’s first battery energy storage projects were commissioned in 2009, and all but two of its 16 administrative regions have facilities in operation, under construction or in the planning stage. The greatest installed capacity is found in the northern regions of Antofagasta and Tarapacá, the country’s solar powerhouses.

How much battery storage capacity does Chile have?

According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity. AES Andes, a subsidiary of U.S. company AES Corp. operates all 64MW at their Angamos and Los Andes substations.

Is lithium ion battery storage available in Chile?

While many projects are under development, lithium - ion battery storage is still limited. According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity.

Update Information

- Companies doing photovoltaic energy storage in Valparaiso Chile

- East Asia energy storage containers are customized for sale

- Chile s professional lithium battery factory for energy storage

- Solar photovoltaic energy storage cabinets for sale in Nassau

- Energy Storage Container Solar Houses for Sale in China Latest Information

- Chile Energy Storage Battery Project

- Chile photovoltaic energy storage battery manufacturer

- Chile energy storage power supply manufacturer

- Energy storage hot sale solar energy price communication base station

- Energy storage battery factory in Valparaiso Chile

- Chile energy storage liquid cooling equipment manufacturer

- Israel photovoltaic energy storage electricity for sale

- Phase change energy storage prices in Valparaiso Chile

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

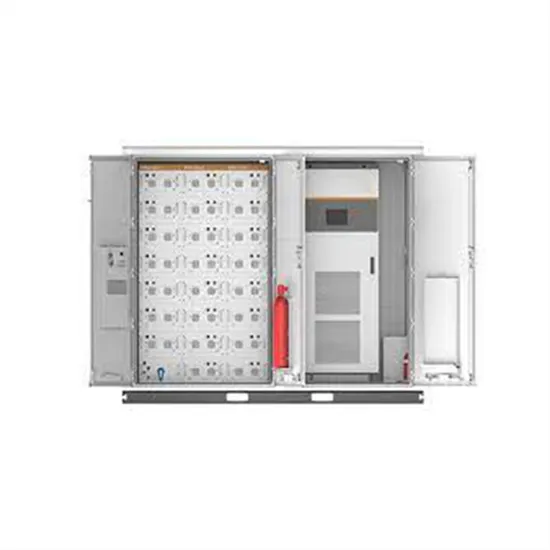

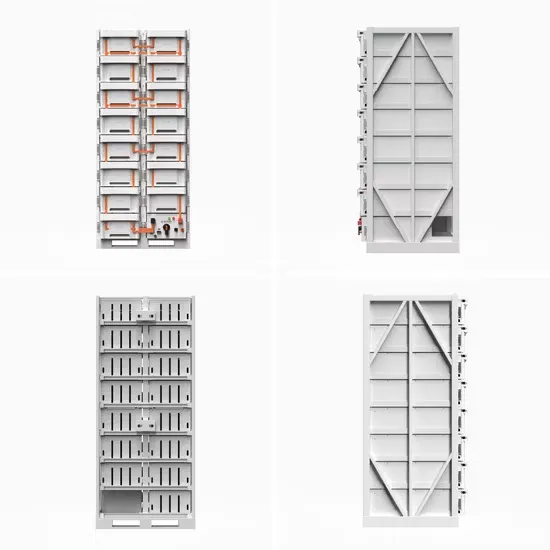

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.