Portable power station 6000w in chad

Home » Portable power station 6000w in chad We are suppliers of all kind of Portable power station 6000w in chad moved in market place for fantastic sales, we''ve Portable power station

Chad Portable Power Station Market (2024-2030) | Forecast,

Historical Data and Forecast of Chad Portable Power Station Market Revenues & Volume By Emergency Power (Residential & Commercial end user) for the Period 2020-2030

Chad energy storage industry | Solar Power Solutions

2020 Grid Energy Storage Technology Cost and Blair, Chad Hunter, Vignesh Ramasamy, Chad Augustine, Greg Stark, Margaret Mann, Vicky Putsche, and developing a systematic method

Chad | Africa Energy Portal

4 days ago · Chad is endowed with the tenth-largest oil reserves in Africa, as well as solar and wind resource potential. The majority of its existing capacity comes from diesel, natural gas

Chad household energy storage power supply direct sales

List of Power Storage companies, manufacturers and suppliers serving Chad (Energy Storage) Savannah Energy to develop up to 500 MW of renewables in Chad British independent energy

How much does a portable energy storage power supply cost in Chad

Our range of products is designed to meet the diverse needs of base station energy storage. From high-capacity lithium-ion batteries to advanced energy management systems, each

Chad 100kWh Energy Storage System – GSL Energy''s

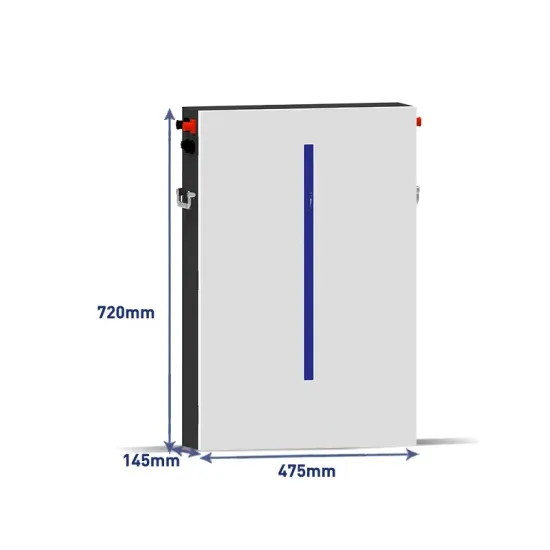

Apr 28, 2025 · In Chad, we successfully installed a 100kWh energy storage system for a local customer. The system consists of 20 5kWh wall-mounted lithium iron phosphate batteries,

Construction of 200MW Photovoltaic Energy Storage Power Station in Chad

Aug 12, 2020 · The agreement involves a feasibility study for the construction, operation and maintenance of a photovoltaic power station with a capacity of 200 MW in the suburbs of

Chad 2025 Energy Storage Power Station

British independent power producer (IPP) Savannah Energy has received approval from the Chadian authorities to build three renewable energy plants with a combined capacity of 500

Chad lithium energy storage power supply price list latest

Overcapacity Concerns: While the energy storage industry''''s prosperity presents opportunities, it also raises concerns about overcapacity. As of July 2023, the capacity of the lithium power

Chad Energy Storage Project Tender Key Opportunities

Summary: The newly announced Chad energy storage project tender offers critical opportunities for renewable energy integration and grid modernization. This article explores the technical

6 FAQs about [Chad Energy Storage Portable Power Wholesale]

What energy resources does Chad have?

The majority of its existing capacity comes from diesel, natural gas and heavy fuel oil generation. Chad is living an energy crisis that undermines its development possibilities with extremely limited electricity access (8%). The country is however rich of energy resources, including fossil fuels with strongest solar and wind energy potential.

How does Chad generate electricity?

Chad currently generates electricity by consuming oil. With the declining cost of new solar generation plants, the Government of Chad and development partners have prioritized solar power throughout the country. Machinery and parts for electricity transmission and distribution are also in demand. Opportunities

Does Chad framework allow private investment in energy production?

Chad framework has allowed private investment in energy production since only in recent years and as of 2018 Currently only one solar IPP (Djermaya – 28MW) is active and expected to reduce power supply failures and global price fluctuation. This project is also part of the Desert To Power Initiative.

Why is Chad a good place to invest in solar power?

Chad’s location in the Sahel, which features brilliant sunshine especially during the dry season, and lack of alternate fuel sources such as coal make solar power an attractive export and investment sector. Chad currently generates electricity by consuming oil.

How many independent power producers in Chad?

There is One (1) active Independent Power Producers (IPPs) in Chad. Law No.036/PR/2019 relating to the national electricity law. Please read the law here

Why is electrification important in Chad?

The Government of Chad and development partners like the World Bank are prioritizing electrification to promote economic growth and inclusion. Per capita electricity consumption is one of lowest in the world and tariffs are among the highest.

Update Information

- Lu Portable Energy Storage Power Supply

- Portable Energy Storage Power 2025

- North America local portable energy storage power supply

- Portable emergency energy storage power station

- Cross-border portable energy storage power supply

- Energy storage outdoor portable 12v power supply

- Nicosia Photovoltaic Power Station Energy Storage Wholesale Manufacturer

- Avalu Portable Energy Storage Power Supply Direct Sales Store

- Portable energy storage power supply solution

- Albania portable energy storage power supply customization

- Malaysia s official portable energy storage power supply

- Rm300 portable energy storage power supply

- Portable energy storage power supply mobile equipment

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.