Energy Storage Battery Distributor in Alexandria Egypt

Alexandria, Egypt''s second-largest city, is embracing renewable energy at an unprecedented pace. With solar installations growing by 18% annually and wind projects expanding across the

Egypt set for 1.1 GWh of battery storage across three projects

Sep 13, 2024 · Earlier this year, state-owned utility Egyptian Electricity Holding Co. held an expressions-of-interest tender for the design, construction and operation of a 8.2 MW solar

Scatec and Amea Power to Build Landmark Solar +Energy Storage

Sep 14, 2024 · Amea Power stated that the Benban project will be Africa''s largest solar + storage project, while the Abydos project will be Egypt''s first-ever centralized large-scale storage

Egypt set for 1.1 GWh of battery storage across three projects

Sep 13, 2024 · Dubai-based developer Amea Power has agreed to build a 1 GW solar plant with a 600 MWh battery energy storage system (BESS) and an additional 300 MWh BESS.

(PDF) Egypt''s Solar Revolution: A Dual Approach to Clean Energy

Jan 15, 2025 · Efficiency and energy storage comparison of PV and CSP technologies, showing their respective advantages for Egypt''s solar energy initiative [48]. Location of Benban Solar

A Comparative Analysis Between Wave and Solar Energy

Mar 8, 2025 · Scenario 3: Incorporates battery storage, increasing energy output to 395.73M kWh with 189,639 kW of PV panels. The LCOE is $0.01425/kWh, NPC is $427.57M, and capital

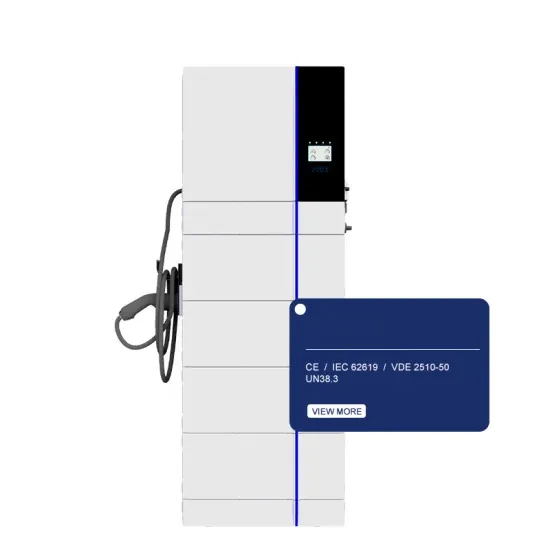

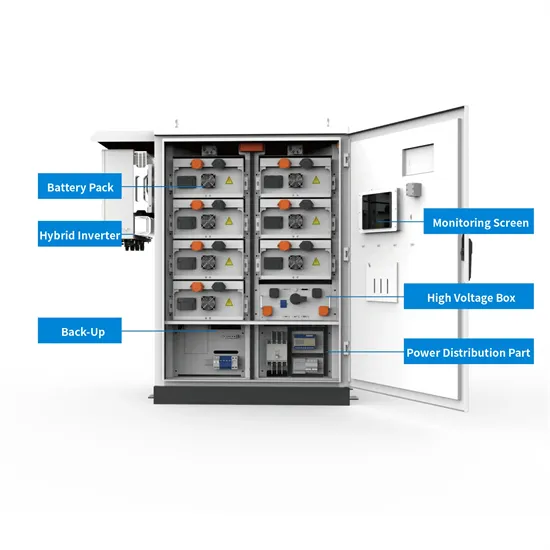

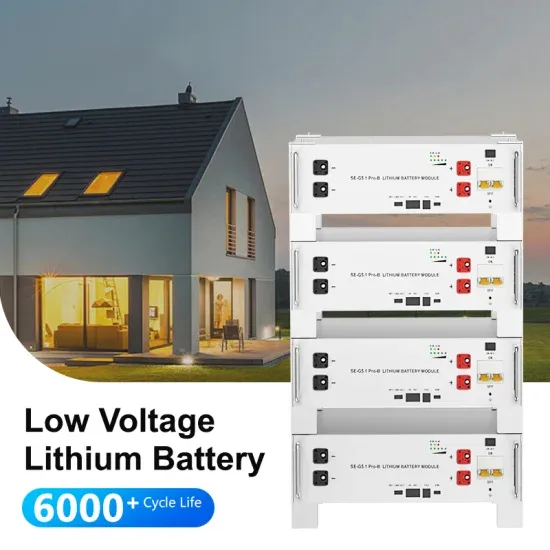

Alexandria Egypt Distributed Energy Storage Lithium Battery

Next-Gen Photovoltaic Modules Engineered for superior efficiency, our photovoltaic modules integrate cutting-edge solar cell technology and anti-reflective coatings to deliver maximum

Chinese companies completed Egypt''s first fully integrated PV energy

8 hours ago · China''s Ambassador in Cairo Liao Liqiang said that Chinese companies have successfully completed Egypt''s first fully integrated photovoltaic (PV) energy storage project,

Masdar, Infinity Power and Hassan Allam Utilities Reach

Nov 20, 2024 · Landmark projects include 1.2GW of solar and 720MWh of battery storage capacity Accelerated timeline expected to see projects operational by 2025 in support of

Photovoltaic battery energy storage in Alexandria Egypt

AMEA Power has signed a Power Purchase Agreement (PPA) to develop Africa''s largest solar PV project and the first utility-scale battery energy storage system in Egypt. Integrated

The viability of battery storage for residential

Summary As a global common trend for fossil fuels independence, renewable energy plays a great role to save a clean source of energy. As a result of the high solar energy potential in

Economic analysis of stand-alone PV-battery system based on new power

Jan 1, 2023 · The battery storage decreases as the number of charging and discharging phases grows because the battery storage stores and provides power several times during the day,

Optimal design of stand-alone hybrid PV/wind/biomass/battery energy

Dec 1, 2021 · The first hybrid system includes PV, WT, Biomass generator, and Battery storage device; the second configuration includes PV with Biomass and Battery, and the last one

Towards a sustainable energy future for Egypt: A systematic

Jun 1, 2022 · The analysis results have shown that using a diesel generator system resulted in higher energy cost, by 69.74%, compared to a PV-battery system and the best solution was

The viability of battery storage for residential photovoltaic system

Dec 11, 2020 · As a result of the high solar energy potential in Egypt, successive incentive polices had been introduced by the Egyptian electricity authority to encourage the deployment of small

6 FAQs about [Photovoltaic battery energy storage in Alexandria Egypt]

Does Scatec have a solar project in Egypt?

In a separate announcement, Norway’s Scatec said it had signed a 25-year PPA with Egyptian Electricity Transmission Co. (EETC) for a 1 GW solar and 100 MW/200 MWh battery storage hybrid project in Egypt. “This will be the first hybrid solar and battery project in Egypt,” said Scatec CEO Terje Pilskog.

How does solar power work in Egypt?

It takes Egypt’s green energy transition to another level by harnessing the power of the sun, not just during the day but also at night, thanks to the combination of solar and battery storage. The project addresses the growing demand for electricity and reduces the need to import expensive fossil fuels.

Is Egypt's first hybrid solar-plus-battery project?

Norwegian developer Scatec ASA has signed a 25-year power purchase agreement (PPA) for a 1 GW solar array and 100 MW/200 MWh battery storage project in Egypt. CEO Terje Pilskog says it is Egypt’s first hybrid solar-plus-battery project.

Could battery storage be a game-changer for Egypt's energy sector?

The integration of battery storage with solar PV is a game-changer for Egypt’s energy sector, providing reliable and dispatchable renewable energy and reducing reliance on fossil fuels. It not only meets Egypt’s current energy needs but also sets a precedent for future dispatchable hybrid renewable energy projects in the region.”

Does AMEA power have a solar project in Egypt?

The latest announcements bring Amea Power’s total renewables capacity in Egypt to 2 GW of solar and 900 MWh of BESS. The company claims to have projects in 20 countries, with a pipeline above 6 GW and 1.6 GW currently in operation and under or near construction.

Which solar projects are being built in Egypt?

The first project involves a 1 GW solar plant with a 600 MWh BESS in the Benban area. The second project is a 300 MWh BESS at the site of Amea Power’s 500 MW Abydos solar array, which is currently under construction. Both projects are in Egypt’s Aswan governorate.

Update Information

- Shanghai Photovoltaic Energy Storage Lithium Battery Factory

- Cameroon Douala Photovoltaic Energy Storage Battery

- EK Photovoltaic Energy Storage Battery

- How long does it take for a photovoltaic energy storage gel battery to be fully charged

- How much does the energy storage power supply in Alexandria Egypt cost

- Industrial energy storage battery cabinet photovoltaic cost

- How much does a photovoltaic energy storage battery cabinet weigh

- 18V photovoltaic energy storage cabinet battery lithium battery pack

- Photovoltaic energy storage battery module

- Nearby energy storage battery cabinet photovoltaic

- Sierra Leone photovoltaic energy storage cabinet lithium battery site cabinet

- 100kw photovoltaic energy storage battery cabinet

- Bucharest photovoltaic power plant energy storage battery

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.