5G Base Station Power Supply System: NextG Power''s

May 21, 2025 · Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Optimal configuration of 5G base station energy storage

Jun 21, 2025 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries.To maximize overall

Communication Base Station Battery Disposal | We Group

The Silent Crisis in 5G Expansion As global 5G infrastructure grows by 19% annually, communication base station battery disposal emerges as a critical yet overlooked challenge.

Communication base station lithium batteries | We Group

Communication Base Station Lead-Acid Battery: Powering Connectivity in the 5G Era In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still

As 5G base station construction process is accelerating, the

Apr 24, 2023 · Large-scale construction directly drives the demand for energy storage batteries, compared lead-acid batteries, it can be seen that the advantages of lithium batteries in the 5G

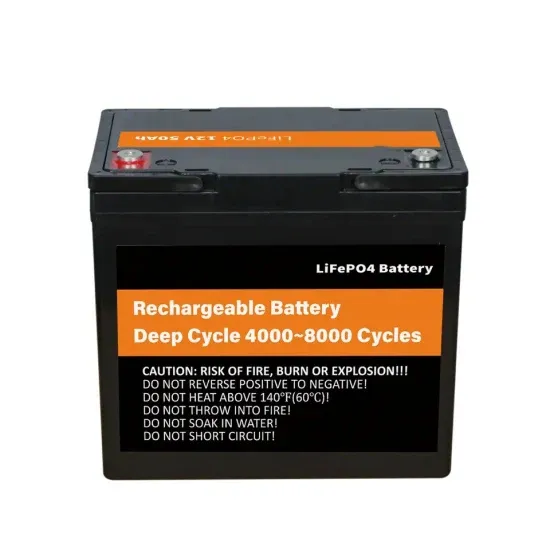

5G base station becomes a new scenario for LiFePO4 battery

Aug 9, 2021 · Traditional communication base stations are mainly based on lead-acid batteries, but the battery has a short service life, low performance, and high requirements for the

5G Base Station Lithium Battery Market

Feb 28, 2025 · A single 48V lithium battery system can replace multiple lead-acid units in 5G base stations, reducing footprint and installation costs. China Mobile reported a 25% reduction in

Application of energy storage lead-acid batteries in 5G base stations

As 5G base station construction process is accelerating, the As of the end of 2018, there was approximately 120,000 base stations in 31 provinces and cities across the country, and the

CTECHI Energy Storage LiFePO4 Batteries Poised to Power 5G Base Station

Discover how CTECHI Energy Storage LiFePO4 batteries are set to revolutionize 5G base station power solutions. As 5G infrastructure expands, the demand for durable, efficient energy

5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

Energy Storage in Telecom Base Stations: Innovations

With the relentless global expansion of 5G networks and the increasing demand for data, communication base stations face unprecedented challenges in ensuring uninterrupted power

Can telecom lithium batteries be used in 5G telecom base stations?

Jul 1, 2025 · Traditional lead - acid batteries have long been used as backup power sources in telecom base stations. They are relatively inexpensive and have a well - established track

Battery technology for communication base stations

Feasibility study of power demand response for 5G base station In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade

Carbon emission assessment of lithium iron phosphate

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Tower base station energy storage battery

Click image to enlarge. Figure 1a Sodium ion batteries present a compelling solution to address the energy needs of telecom towers and 5G base stations, offering several advantages: Off

Japan Battery for 5G Base Station Market 2026: Investment

Jun 22, 2025 · Advanced battery management systems (BMS), thermal stability innovations, and the shift from lead-acid to LiFePO4 chemistries are significantly influencing vendor strategies.

Base station lead-acid battery treatment

The method has been successfully used in industry production. Recycling lead from waste lead-acid batteries has substantial significance in environmental protection and economic growth.

5G communication iron phosphate battery -Lithium -|stacking

Apr 3, 2023 · The high level of power consumption of 5G base stations puts forward new demand for the communication power system. We expect that in the future important construction

Uninterrupted Power for 5G Base Stations: How the 51.2V

Apr 14, 2025 · While a typical lead-acid battery lasts 300-500 cycles (2-3 years) before capacity plummets, the 51.2V rack battery delivers 6,000+ cycles at 80% depth of discharge, ensuring a

Lithium Battery for 5G Base Stations Market

Feb 9, 2025 · China dominates lithium battery procurement for 5G base stations, driven by aggressive nationwide 5G deployment. With over 3.3 million 5G base stations installed by late

Battery for Communication Base Stations Market

The Battery for Communication Base Stations market can be segmented by battery type, including lithium-ion, lead acid, nickel cadmium, and others. Among these, lithium-ion batteries

Battery for Communication Base Stations Market

Operators are aggressively replacing lead-acid batteries with lithium-ion variants, driven by 60% higher energy density and 50% longer cycle life. Deutsche Telekom''s modernization program

Update Information

- How much is the photovoltaic power generation power of the lead-acid battery of the Ottawa communication base station

- Port Moresby communication base station lead-acid battery module

- Financial 5G communication base station battery energy storage system looking for subcontractor

- Netherlands communication base station lead-acid battery cabinet manufacturer

- South Korea 5g communication base station battery energy storage system construction ESS system

- How much does it cost to build a communication base station lead-acid battery

- Liquid flow battery for 5G communication base station in Windhoek

- Eastern Europe 5G communication base station battery energy storage system construction project

- Can the lead-acid battery of a communication base station use 220v

- Lead-acid battery for Yemen Chabu communication base station

- Cameroon 5G communication base station lithium ion battery cost

- Gitega communication base station lead-acid battery price

- Oman 5G communication base station battery energy storage system construction bidding

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.