4GW GW-Class Centralized PV Power Station in Guangdong

Feb 7, 2025 · Explore the 4GW GW-Class centralized PV power station in Guangdong, China, designed for solar self-consumption and contributing to renewable energy generation. This

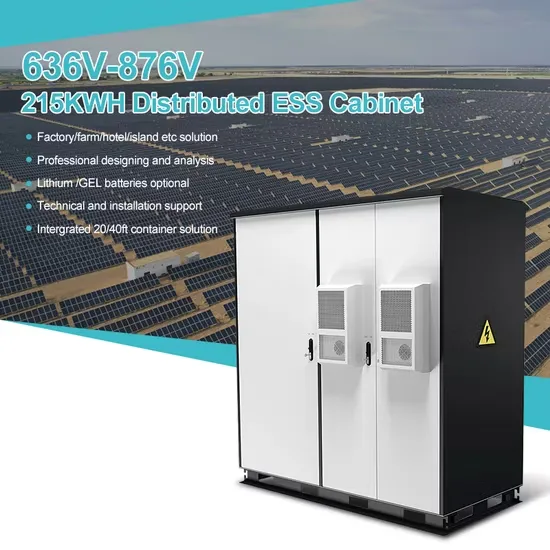

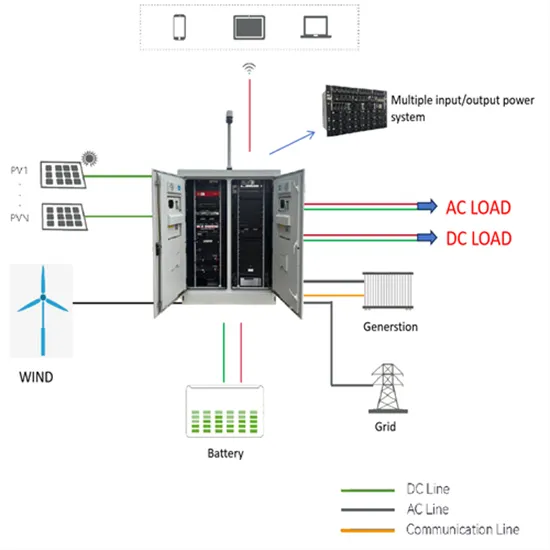

Energy storage power plant equipment

This energy storage system makes use of the pressure differential between the seafloor and the ocean surface. In the new design, the pumped storage power plant turbine will be integrated

2025 energy storage power station investment

Grid-scale battery storage investment has picked up in advanced economies and China,while pumped-storage hydropower investment is taking place mostly in China Global investment in

Technologies and economics of electric energy storages in power

Nov 19, 2021 · As fossil fuel generation is progressively replaced with intermittent and less predictable renewable energy generation to decarbonize the power system, Electrical energy

China reaches over 70GW of BESS, DC block prices ''stable''

Jan 24, 2025 · China has reached well over 70GW of installed BESS capacity, while DC block prices appear to be ''stable'', a local metals price agency said.

Pumped storage power stations in China: The past, the

May 1, 2017 · Abstract The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Economic Analysis of Energy Storage Stations: Costs, Profits,

Jun 22, 2022 · Initial investments (60-80% of total cost): Battery systems still eat up 50-60% of the pie at $0.5-$0.95/Wh [9], but wait - that''s 40% cheaper than 2020 prices! Northwest China''s

World''s largest compressed air energy storage power station

May 6, 2024 · The power station, with a 300MW system, is claimed to be the largest compressed air energy storage power station in the world, with highest efficiency and lowest unit cost as well.

2025 energy storage power station ranking

Developers and power plant owners plan to significantly increaseutility-scale battery storage capacity in the United States over the next three years,reaching 30.0 gigawatts (GW) by the

Cost Composition and Price of Energy Storage Power Stations

While battery prices dropped 89% since 2010 (BloombergNEF), recent volatility in lithium carbonate prices – swinging from $7,000 to $78,000/ton within 18 months – has complicated

How much is the unit price of energy storage power station

Jul 28, 2024 · The unit price of energy storage power station EPC contracts is influenced by numerous dynamic factors such as technology, location, and project scale. Evaluating these

Energy storage power station cost curve

Mar 25, 2025 · The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox

Prices of foreign energy storage power stations

With the development of the electricity spot market, pumped-storage power stations are faced with the problem of realizing flexible adjustment capabilities and limited profit margins under

CHINA''S ACCELERATING GROWTH IN NEW TYPE

Jun 13, 2024 · The scope includes two categories: dispatch-controlled new type energy storage and self-used new type energy storage by power stations. The former one refers to the new

6 FAQs about [Gw-class energy storage power station price]

How much does energy storage cost in China?

In what is described as the largest energy storage procurement in China’s history, Power Construction Corporation of China (PowerChina) is targeting an unprecedented cumulative storage capacity of 16 GWh. The bids were opened on December 4. The tender attracted 76 bidders, with quoted prices ranging from $60.5/kWh to $82/kWh, averaging $66.3/kWh.

What is the largest energy storage procurement in China's history?

The tender marks the largest energy storage procurement in China’s history. In what is described as the largest energy storage procurement in China’s history, Power Construction Corporation of China (PowerChina) is targeting an unprecedented cumulative storage capacity of 16 GWh. The bids were opened on December 4.

What does 'new energy storage' mean for China?

Trade body China Energy Storage Alliance (CNESA) said last week (15 January) that ‘new energy storage’ capacity reached 78.3GW/184.2GWh by the end of 2024, a term it appears to use to describe technologies other than pumped hydro energy storage.

How much energy storage capacity will China have by 2024?

Separate figures, from the National Energy Administration (NEA) cited in state-owned Xinhua News Agency, said that the total installed capacity of new energy storage projects reached 73.4GW by the end of 2024. With an average duration that indicates a total capacity of around 73.4GW/168GW.

What are energy storage technologies?

Informing the viable application of electricity storage technologies, including batteries and pumped hydro storage, with the latest data and analysis on costs and performance. Energy storage technologies, store energy either as electricity or heat/cold, so it can be used at a later time.

How will powerchina select a qualified supplier for energy storage system equipment?

According to the previously announced plan by PowerChina, this tender aims to select qualified suppliers for energy storage system equipment for 2025-2026. After the selection, a framework agreement will be signed.

Update Information

- Power station energy storage battery price trend analysis

- Price of energy storage power station operation and maintenance system

- Skopje Power Station Energy Storage System Price Query

- Price of prefabricated cabin for energy storage power station in Liberia

- Price structure of energy storage power station

- Peak Valley Energy Storage Power Station Price

- Ljubljana Air Energy Storage Power Station

- Armenia s world-class energy storage power station

- Industrial Energy Storage Power Station Company

- Sales price of flywheel energy storage cabinet for communication base station

- User-side energy storage power station benefits

- Cascade direct-mounted energy storage power station

- Area required for energy storage power station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.