Top 100 Energy Companies in Czechia (2025) | ensun

Overview EP Infrastructure (EPIF) is a leading European energy infrastructure utility focused on gas transmission, gas and power distribution, heat and power generation and gas storage.

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Discover the current state of energy storage companies in Europe, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Energy Industry Suppliers In Czech Republic

Find the top Energy industry suppliers and manufacturers in Czech Republic from a list including Delta-T Devices Ltd., DILO Armaturen und Anlagen GmbH and Truxor Wetland Equipment AB

ENERGY STORAGE TECH STARTUPS IN PRAGUE CZECH

Yes, residential grid energy storage systems, like home batteries, can store energy from rooftop solar panels or the grid when rates are low and provide power during peak hours or outages,

New Opportunities for Battery Storage in the Czech Republic

Mar 27, 2025 · With the growing share of renewable energy and the rapidly decreasing costs of battery storage technologies, the Czech Republic is experiencing a new energy boom.

Why Prague Inverter Manufacturers Are Leading the Global Solar Energy

Summary: Prague-based inverter manufacturers are reshaping renewable energy systems with innovative technology and global adaptability. This article explores their competitive

Energy Storage Tech in Prague, Czech Republic

Jul 9, 2025 · The Energy Storage Tech sector in Prague, Czech Republic comprises 15 companies, including 5 funded companies having collectively raised $3.79M in venture capital

Top 31 Battery Storage Companies in Czechia (2025) | ensun

Information about Battery Storage in Czechia The Battery Storage industry in Czechia is growing rapidly, driven by the country''s commitment to renewable energy and sustainability. Key

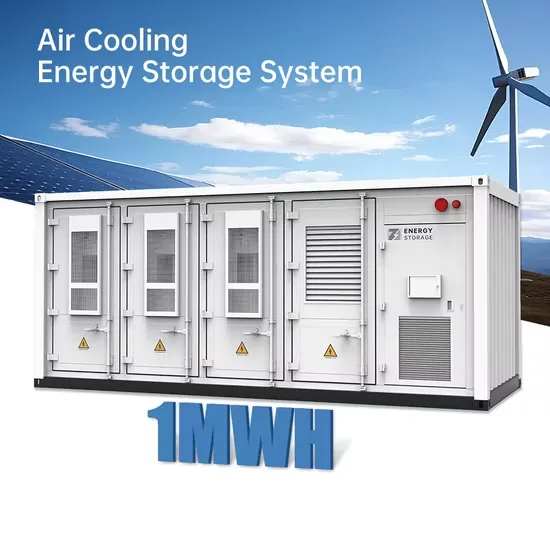

Prague energy storage container custom manufacturer

Container systems address all the standard requirements for battery storage, whether it is saving energy costs through the use of stored energy for self-consumption, elimination of micro

Top 52 Energy Storage Companies in Czechia (2025) | ensun

The company specializes in sustainable and innovative modular energy storage systems, offering products like energy storage units and management systems. Their focus on efficient and

Czech Republic Energy Storage Market (2025-2031)

6Wresearch actively monitors the Czech Republic Energy Storage Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

5 FAQs about [Prague Outdoor Energy Storage Company]

Why is battery storage important in the Czech Republic?

To do so, battery storage will be essential. By coupling onsite generation with battery energy storage systems (BESS), organisations will be able to really monetise their renewable energy assets. What triggered the fast growth of renewables in the Czech Republic?

Will a battery storage system help Czech companies achieve net zero?

The high penetration of renewable generation projects in the region could deliver a large amount of clean energy and really accelerate the journey to net zero, but at the moment Czech companies are not in a position to reap the full benefits of solar and other renewable energy sources. To do so, battery storage will be essential.

How has the energy crisis impacted the Czech Republic?

With coal dominating the energy mix, the Czech Republic has traditionally enjoyed low electricity prices and a steady supply of domestic fuel. However, the recent energy crisis, together with pressure from stakeholders and regulatory bodies to decarbonise, has triggered an unprecedented shift in the country’s energy market.

Why are Czech businesses investing in renewable projects without subsidies?

The subsidy increases to cover up to 75% of costs for community projects. But what we noticed at Wattstor is that Czech businesses are investing in renewable projects even in the absence of subsidies, because they have realised the strong business case for generating clean energy on site.

How does the Czech government cope with higher energy bills?

Unlike other European countries, the Czech Government has traditionally relied on the market to self-regulate, avoiding state intervention. This means that as prices rose, consumers and businesses had to cope with higher energy bills.

Update Information

- Prague portable energy storage battery company

- Kampala Outdoor Communication Battery Cabinet Company Energy Storage Battery

- Montevideo Outdoor Energy Storage Company

- Spain Barcelona outdoor energy storage battery company

- Prague local energy storage battery company

- Belgrade outdoor energy storage cabinet export company

- Energy Storage Outdoor Power Supply Company

- Outdoor Energy Storage Customers

- Romanian electrochemical energy storage company

- Bolivia s local energy storage company

- East African Energy Storage Backup Power Company

- Egypt Liquid Cooling Energy Storage Company

- Outdoor Wireless Energy Storage Container Base Station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.