What is the Power Consumption of a 5G Base Station?

Nov 15, 2024 · Compared to its predecessor, 4G, the energy demand from 5G base stations has massively grown owing to new technical requirements needed to support higher data rates

Global Energy Interconnection Journal Press

Mar 18, 2022 · Furthermore, the power and capacity of the energy storage configuration were optimized. The inner goal included the sleep mechanism of the base station, and the

Optimization Control Strategy for Base Stations Based on

Mar 31, 2024 · With the maturity and large-scale deployment of 5G technology, the proportion of energy consumption of base stations in the smart grid is increasing, and there is an urgent

The business model of 5G base station energy storage

The literature [2] addresses the capacity planning problem of 5G base station energy storage system, considers the energy sharing among base station microgrids, and determines the

Impact of 5G Industry Development on China s

The current long-term electricity demand forecast mainly targets a certain region [2] or the major industries [3], with less involvement in the digital industry. The research on 5G electricity

Evaluation of maximum access capacity of distributed

Jun 5, 2024 · Abstract A method for assessing the maximum access capacity (MAC) of distributed photovoltaic (PV) in distribution networks (DNs) considering the dispatchable potential of 5G

Research on decentralized resource operation optimization

Apr 22, 2024 · 1. INTRODUCTION With the large-scale growth of the number of 5G base stations (5GBSs), the electricity costs and investment and operation costs of communication base

5G base station saves energy and reduces consumption

Dec 18, 2023 · In 5G communications, base stations are large power consumers, and about 80% of energy consumption comes from widely dispersed base stations. It is predicted that by

5G Power: Creating a green grid that slashes

Jun 6, 2019 · Base stations with multiple frequencies will be a typical configuration in the 5G era. It''s predicted that the proportion of sites with more than five

Multi‐objective interval planning for 5G base

Jul 23, 2024 · Large-scale deployment of 5G base stations has brought severe challenges to the economic operation of the distribution network, furthermore,

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · Furthermore, the power and capacity of the energy storage configuration were optimized. The inner goal included the sleep mechanism of the base station, and the

Electric Load Profile of 5G Base Station in Distribution

Feb 10, 2022 · This paper proposes an electric load demand model of the 5th generation (5G) base station (BS) in a distribution system based on data flow analysis. First, the electric load

Energy consumption optimization of 5G base stations

Aug 1, 2023 · 5G base station (BS), as an important electrical load, has been growing rapidly in the number and density to cope with the exponential growth of mobile data traffic [1]. It is

6 FAQs about [Electric power of 5g base station]

What is 5G base station?

1. Introduction 5G base station (BS), as an important electrical load, has been growing rapidly in the number and density to cope with the exponential growth of mobile data traffic . It is predicted that by 2025, there will be about 13.1 million BSs in the world, and the BS energy consumption will reach 200 billion kWh .

How much power does a 5G station use?

The power consumption of a single 5G station is 2.5 to 3.5 times higher than that of a single 4G station. The main factor behind this increase in 5G power consumption is the high power usage of the active antenna unit (AAU). Under a full workload, a single station uses nearly 3700W.

Why should a 5G base station have a backup battery?

The backup battery of a 5G base station must ensure continuous power supply to it, in the case of a power failure. As the number of 5G base stations, and their power consumption increase significantly compared with that of 4G base stations, the demand for backup batteries increases simultaneously.

Does a 5G base station use energy storage power supply?

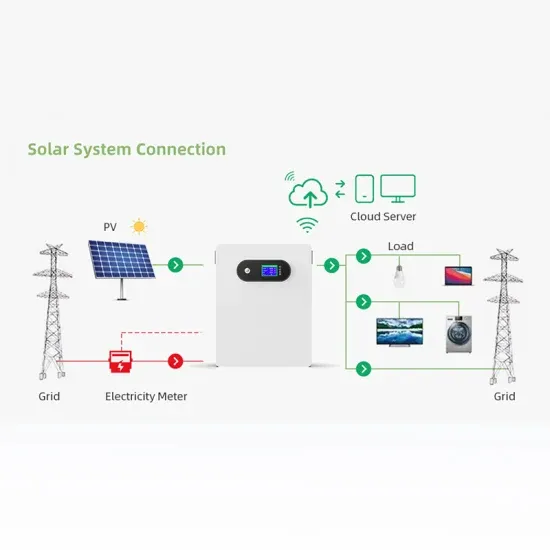

In this article, we assumed that the 5G base station adopted the mode of combining grid power supply with energy storage power supply.

What is 5G BS power consumption?

The 5G BS power consumption mainly comes from the active antenna unit (AAU) and the base band unit (BBU), which respectively constitute BS dynamic and static power consumption. The AAU power consumption changes positively with the fluctuation of communication traffic, while the BBU power consumption remains basically unchanged , , .

Why does 5G use more power than 4G?

The data here all comes from operators on the front lines, and we can draw the following valuable conclusions: The power consumption of a single 5G station is 2.5 to 3.5 times higher than that of a single 4G station. The main factor behind this increase in 5G power consumption is the high power usage of the active antenna unit (AAU).

Update Information

- Electric power of 5g base station

- South Sudan Electric Power Construction 5g Energy Base Station

- Tiraspol Electric Power Construction 5g Base Station

- China Communications 5g low power generation base station

- Malaysia 5g communication base station wind power construction project

- 5g base station wind power module

- Why does 5G base station backup power use lithium iron phosphate

- How many sites are needed for 5G micro base station power generation nationwide

- Doha 5g communication base station photovoltaic power generation system

- 5g base station power consumption is turned off at night

- Niue 5g base station power supply charging standards

- 5g base station power design

- Jakarta 5g base station power supply service

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.