LS Power closes acquisition of Algonquin''s non

Jan 9, 2025 · The acquisition adds to LS Power''s existing fleet of over 23,000 MW of renewable, energy storage, flexible gas, and renewable fuels generation

LS Power Agrees to Acquire Large Scale Renewable Energy

Aug 9, 2024 · Founded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading

LS Power Expands Clean Energy Platform through Solar Acquisition

May 5, 2021 · 1,600+ MW long-duration pumped storage hydro platform, the largest unregulated pumped storage fleet in the U.S.; 140+ MW of wind power in operation, with more renewable

LS Power Spins Off 18 Northeast Gas-Fired Plants into

Aug 14, 2024 · LS Power, headquartered in New York City, has developed or acquired 47,000 megawatts (MW) of power generation, including utility-scale solar, wind, hydro, battery energy

LS Power Completes Acquisition of Algonquin Power

Aug 13, 2025 · - LS Power has completed its acquisition of Algonquin Power & Utilities Corp.''s renewable energy business. - This acquisition enhances LS Power''s renewable energy

Competitive Power Highlights: America''s Competitive Power

Aug 18, 2025 · Competitive power companies are ramping up investment to meet rising energy demand – including a $25 billion generation partnership from Energy Capital Partners and

LS Power Acquires ENGIE Services, Relaunches as

Jun 13, 2025 · Their cutting-edge capabilities in energy efficiency services and low-carbon offerings are a strategic fit as we continue to expand our portfolio

LS Power Energizes Largest Battery Storage Project in the

Aug 19, 2020 · Founded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading

LS Power launches Rev Renewables to operate

Aug 12, 2021 · Rev has a 2.4-GW portfolio of operating storage, solar and wind projects, including a California-based battery storage portfolio (615 MW by the

LS Power Announces Global Clean Energy Leader SK E&S Co.

Oct 18, 2021 · Founded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading

LS Power acquires Algonquin Power''s renewable energy

Jan 9, 2025 · Energy infrastructure development and operating company LS Power has acquired Algonquin Power & Utilities'' renewable energy business, enhancing its renewable energy

LS Power Energizes Largest Battery Storage Project in

Feb 3, 2021 · Since its inception in 1990, in addition to its development of over 660 miles of high voltage transmission, LS Power has developed, constructed, managed or acquired more than

Energy Storage Solutions & Services | LS Energy

Energy storage allows utilities and consumers to smooth production and time shift renewable energy. LS Energy Solutions'' products come with multiple advanced features and can be

A Proven Provider of Energy Storage Solutions

May 23, 2023 · y, LS Energy Solutions is your ideal partner. Combining LS Energy Solutions'' advanced energy storage power-conversion systems (PCS), software, and integration

LS Power Completes Acquisition of 3,500 MW of Power Generation

Jul 3, 2014 · Founded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading

LS Power Agrees to Acquire 3,500 MW of Power Generation

Apr 21, 2014 · Founded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading

LS Power Completes Acquisition of Illinois Power Generation

Jul 12, 2016 · Since inception, LS Power has developed or acquired 50,000 MW of power generation, including utility-scale solar, wind, hydro, battery energy storage, and natural gas

LS Power Acquires Algonquin Power''s Renewable Energy

Energy infrastructure development and operating company LS Power has acquired Algonquin Power & Utilities'' renewable energy business, enhancing its renewable energy portfolio, which

4 FAQs about [Ls Solar power generation and energy storage]

Who is LS Energy Solutions?

ers in Innovation.About LS Energy SolutionsLS Energy Solutions, an LS Group company, is a leading provid r of grid-connected energy storage solutions. The company brings over a decade of experience innovating energy storage and related technologies, from the first grid-connected lithium-ion storage system and to now having more than 1.

Where are LS Power assets located?

Approximately 2.7 GW of the portfolio’s assets are located in the US across NYISO, MISO, PJM, ERCOT, and CAISO markets, with the remaining 300 MW located in Canada. LS Power Project Map (Image Courtesy Of LS Power).

Does LS Power own Algonquin Power & Utilities?

LS Power, a development, investment, and operating company focused on the North American power and energy infrastructure sector, announced it has reached an agreement with Algonquin Power & Utilities Corp. to acquire its renewable energy business (The Renewables Business) for an estimated US$2.5 billion.

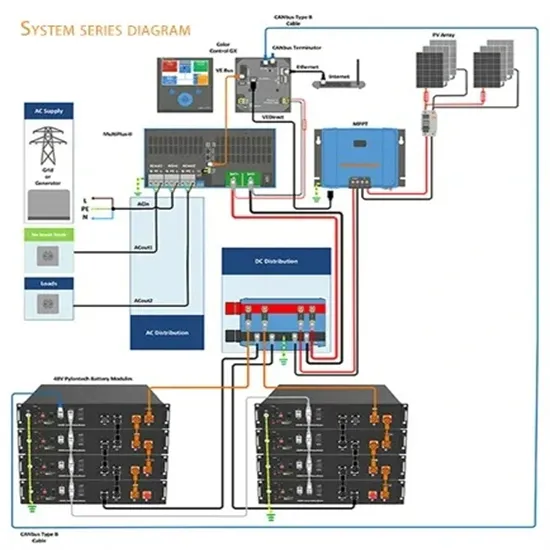

What is a L string inverter?

l string inverters.AiON-SIS string invertersAiON-SIS is our third generation bidirectional string inverter for energy storage and the fundamental bui

Update Information

- The world s largest wind and solar energy storage power generation

- Wind power generation wind and solar energy storage

- Solar power generation and energy storage quotation in Sydney Australia

- Wind and solar power generation energy storage solution

- China-Africa Energy Storage Solar Power Generation Manufacturer

- Mbabane Solar Power Generation and Energy Storage

- Zimbabwe Solar Power Generation and Energy Storage

- Eastern European Solar Power Generation and Energy Storage Company

- Botswana wind and solar energy storage power generation

- Solar power generation and energy storage methods

- China Energy Storage Counter Solar Power Generation Company

- Solar Photovoltaic Power Generation and Energy Storage Equipment

- Introduction to Solar Power Generation and Energy Storage System

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.