Haiti energy storage base project bidding

Why is Haiti struggling to modernise its energy sector? Haiti''s recent battles to modernise its energy sector serve as a stark lesson for how fraught the business of energy transition can be.

Energy Storage Industry Base Project Bidding: What You

Let''s cut to the chase: If you''re reading about energy storage industry base project bidding, you''re likely a developer, investor, or policymaker trying to navigate this fast-evolving sector. Maybe

The business model of 5G base station energy storage

Based on the analysis of the feasibility and incremental cost of 5G communication base station energy storage participating in demand response projects, combined with the interest

Energy management strategy of Battery Energy Storage Station

Sep 1, 2023 · In recent years, electrochemical energy storage has developed quickly and its scale has grown rapidly [3], [4]. Battery energy storage is widely used in power generation,

5G Base Station Energy Storage Bidding: What You Need to

Jun 29, 2021 · A 5G基站储能招标 (5G base station energy storage bidding) war where companies are racing to supply battery systems faster than you can say "buffering"! With over 816,000

The Bidding Optimization Strategy of Battery Swapping Stations

Apr 27, 2025 · This integrates energy storage degradation costs from following frequency regulation signals into the objective function, thereby optimizing the bidding strategy of EV and

Optimal bidding strategy for price maker battery energy storage

May 1, 2025 · Develops an optimal price-quantity bidding strategy for BESS in electricity markets. Integrates a comprehensive BESS degradation cost-model into the bidding strategy.

Bidding Strategy of Battery Energy Storage Power Station

Oct 8, 2024 · Aiming at the multi-time scale clearing mechanism of the actual frequency regulation market, this paper divides the bidding strategy of BESSs to participate in the frequency

Robust market-based battery energy storage management

Nov 20, 2024 · We present a robust battery energy storage system (BESS) management strategy for simultaneous participation in frequency containment reserve (FCR) and

Energy Storage Power Station Bids: Your Guide to Winning

Ever wondered why everyone''s suddenly talking about energy storage power station bids? the global energy storage market is projected to grow at 33% CAGR through 2030, and China

1.6GWh Battery Energy Storage System Tender Launched!

Apr 14, 2025 · Chinese state-owned enterprises such as PowerChina and China Energy Engineering Corporation (CEEC), which have experience in undertaking new energy power

Incentive Bidding Strategies for the Participation of Battery Energy

Apr 27, 2025 · Using a 2-node system and a modified IEEE 39-node system as examples, the basic characteristics of the market clearing electricity price mechanism for energy storage

5g base station energy storage battery bidding

Modeling and aggregated control of large-scale 5G base stations and backup energy storage This paper integrates a novel flexible load, 5G base stations (gNBs) with their backup energy

(PDF) An optimized demand-response operation method of

Nov 1, 2021 · An optimized demand-response operation method of regional integrated energy system considering 5G base station energy storage November 2021 Journal of Physics

China''s Largest Grid-Forming Energy Storage Station

Apr 9, 2024 · The station was built in two phases; the first phase, a 100 MW/200 MWh energy storage station, was constructed with a grid-following design and was fully operational in June

Optimal bidding strategy for price maker battery energy storage

May 1, 2025 · This study presents a novel methodology to address bi-level optimization challenges, specifically targeting Battery Energy Storage Systems (BESSs) in competitive

6 FAQs about [Base station energy storage replacement bidding]

How effective is the bidding strategy of energy storage power station?

The bidding strategy of energy storage power station formulated in most papers relies on the day-ahead predicted price and regulation demand, and the effectiveness of the bidding strategy is based on the premise that day-ahead forecast is accurate [9, 10, 11].

What is a battery energy storage power station (Bess)?

In recent years, battery energy storages stations (BESSs) account for the largest proportion in large-scale energy storage power station projects due to its advantages such as rapid response, high integrated power, decreasing cost year by year and short construction cycle.

What is the bidding strategy of Bess in the frequency regulation market?

Aiming at the multi time scale clearing mechanism in the frequency regulation market, this paper divides the bidding strategy of the BESS participating in the frequency regulation market into two stages: the day ahead market (DAM) and the real time market (RTM).

What is a joint energy-reserve procurement strategy?

Market operators use either sequential or joint energy-reserve procurement strategies. Joint markets clear energy and reserves simultaneously, accounting for interdependencies, using UC optimization at the unit level . Examples include U.S. markets such as PJM, CAISO, ERCOT, MISO, and NYISO , .

What is the most reliable bidding strategy for a Bess?

According to the analysis in Sect. 5.1, the most reliable bidding strategy for each BESS at this time is to declare its marginal cost curve as its supply function, so as to determine its own frequency regulation mileage quotation and capacity. Therefore, in this case, the five BESSs take their marginal costs as the declared supply function.

Can market participants bid for regulation reserves?

Market participants can bid for regulation reserves, and the CAISO employs a joint procurement approach for these reserves along with energy and contingency reserves. Regulation reserves are categorized into two types: Regulation Up (Reg-Up) and Regulation Down (Reg-Down).

Update Information

- Algeria Telecom 5g base station energy storage bidding

- Valletta Communication Base Station Flywheel Energy Storage Project Bidding Website

- Oman 5G communication base station battery energy storage system construction bidding

- Nanya Communication Base Station Battery Energy Storage System Bidding Project

- Communication base station energy storage ranking

- Astana Communication Base Station Battery Energy Storage System Agreement

- Communication base station lithium battery energy storage field

- Pyongyang base station lithium battery energy storage 40kw inverter

- Does wind power communication have base station energy storage cabinets

- What is the volume of a 1MW base station container energy storage power station

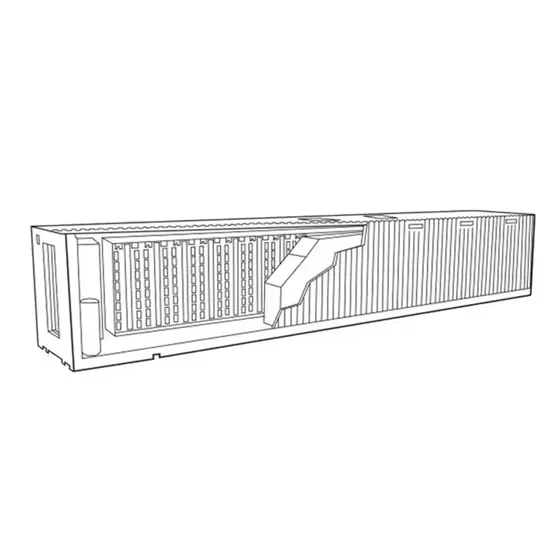

- Energy Storage Container Battery System ESS Power Base Station

- Oslo communication base station energy storage battery requirements

- Namibia Mobile Huawei Communication Base Station Battery Energy Storage System

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.