Global Communication Base Station Body Trends: Region

Apr 5, 2025 · The communication base station body market exhibits a moderately concentrated landscape, with several key players capturing significant market share. Concentration is

Onboard Base Station: The Communication Hub of the

Mar 13, 2025 · The advent of onboard base stations aims to solve these problems. Acting as mobile communication fortresses, they provide crucial communication support in critical

Communication Base Station Industry Outlook | We

As global 5G adoption surpasses 1.3 billion connections, the communication base station industry faces a critical juncture. Did you know each 5G mmWave cell site consumes 3x more energy

Base Station market Analysis

Aug 17, 2025 · With the increasing demand for seamless connectivity and the rapid expansion of 5G networks, the base station market is expected to experience substantial growth in the

Battery for Communication Base Stations Market Size and

Mar 26, 2025 · The global market for batteries in communication base stations is experiencing robust growth, projected to reach $1692 million in 2025 and maintain a Compound Annual

Communication Base Station Energy Storage Lithium Battery Sales Market

Jun 30, 2025 · The future of the global communication base station energy storage lithium battery sales market looks promising with opportunities in the communication base station, hospital,

5G Communication Base Station Antenna Market

Nov 28, 2024 · Conclusion The 5G communication base station antenna market is a critical enabler of the global 5G revolution, driving innovation, connectivity,

Communication Base Station Market Analysis | We Group

As global 5G subscriptions surpass 1.4 billion in Q3 2023, operators face a critical dilemma: How can communication base station deployments keep pace with 34% annual data traffic growth

UHF Base Stations for Urban and Indoor Communication

In professional communication, UHF (Ultra High Frequency) base stations are an indispensable tool for ensuring robust and reliable connectivity in challenging environments. From urban

Future Trends Shaping Communication Base Station Body

Mar 30, 2025 · The global communication base station body market is experiencing robust growth, driven primarily by the rapid expansion of 5G networks worldwide and the increasing

Global Communication Base Station Body Trends: Region

Apr 5, 2025 · The global Communication Base Station Body market is experiencing robust growth, driven by the escalating demand for high-speed data and improved network coverage fueled

Communication Base Station Isolated Interfaces Analysis

Jul 6, 2025 · The Communication Base Station Isolated Interfaces market is experiencing robust growth, driven by the increasing demand for high-speed, reliable, and secure communication

6 FAQs about [Base station communication industry]

What are the opportunities for the base station market?

The base station market presents numerous opportunities for growth and innovation. One of the primary opportunities lies in the deployment of 5G networks. The transition to 5G is driving significant investments in new infrastructure, including base stations.

What factors drive the base station market?

A significant growth factor driving this market includes the widespread adoption of 5G technology, which necessitates the development of new infrastructure and the upgrade of existing systems to meet the high-speed network demands. One of the primary growth drivers for the base station market is the exponential rise in mobile data traffic.

What is the global base station market size?

The Base Station market has been segmented on the basis of The global base station market size was valued at USD 32 billion in 2023 and is projected to reach USD 65 billion by 2032, registering a CAGR of approximately 8.5% during the forecast period.

Which region will dominate the base station market?

Regionally, Asia Pacific is expected to dominate the base station market during the forecast period. This dominance is attributed to the rapid urbanization and industrialization in countries like China and India, coupled with significant investments in 5G infrastructure.

How is the base station market segmented?

The base station market is segmented by application into telecommunications, military and defense, transportation, and others. Telecommunications remains the largest application segment, driven by the ever-increasing demand for mobile data and the continuous evolution of mobile network technologies.

Can a base station market report be customized?

Yes, the report can be customized as per your need. The base station market is segmented by technology into 2G, 3G, 4G, and 5G. Each generation of technology represents a significant leap in capabilities and performance. Initially, 2G and 3G technologies laid the foundation for mobile communications, providing basic voice and data services.

Update Information

- Communication industry base station photovoltaic

- Communication Green Base Station Industry Ranking

- The development of 5G base station communication industry

- Wireless communication base station hybrid energy st503

- How heavy is the 4G outdoor communication base station battery energy storage system cabinet

- Communication base station energy storage 48v battery

- Pretoria communication base station battery cabinet spot price

- What are the functions of the rooftop communication base station inverter

- Belgian communication base station wind and solar complementary lightning protection grounding

- Communication base station power outage time

- Private network communication base station super capacitor

- Swiss Communication Base Station Energy Storage Battery Processing Plant

- Can a communication base station inverter be built in Xiaoli and connected to the grid

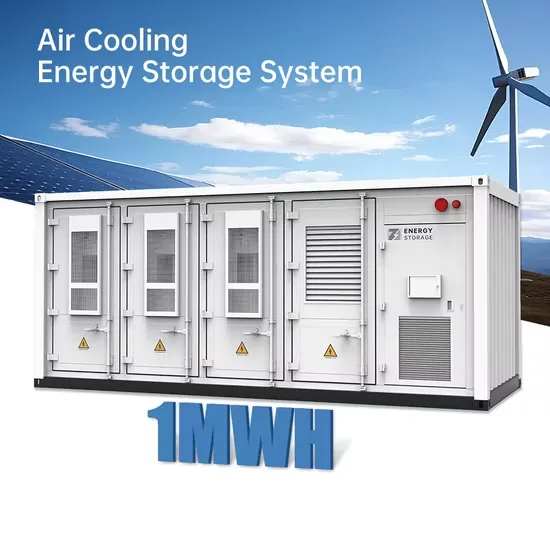

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.